How Many Bitcoin Are Currently in Existence?

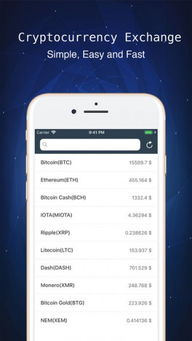

In the world of cryptocurrency, Bitcoin (BTC) stands out as a pioneer and the most recognized digital asset. Understanding the mechanics of its supply is crucial for anyone interested in investing or participating in the Bitcoin ecosystem. This article delves into the total supply of Bitcoin, its limitations, and what these numbers mean for investors and the market.

In the world of cryptocurrency, Bitcoin (BTC) stands out as a pioneer and the most recognized digital asset. Understanding the mechanics of its supply is crucial for anyone interested in investing or participating in the Bitcoin ecosystem. This article delves into the total supply of Bitcoin, its limitations, and what these numbers mean for investors and the market.

The Total Supply of Bitcoin

Bitcoin has a capped supply of 21 million coins, a feature designed to mimic the scarcity of precious metals like gold. This limit was established by Bitcoin’s creator, Satoshi Nakamoto, and is hard-coded into the Bitcoin protocol. As of now, approximately 19 million Bitcoins have been mined, leaving around 2 million Bitcoins yet to be mined. However, due to the nature of mining and the way blocks are created, the final Bitcoin is expected to be mined around the year 2140.

The mining process, which is essential to the Bitcoin network, slows down over time through an event known as the “halving.” This event, which occurs approximately every four years, halves the reward Bitcoin miners receive. Initially, the reward was 50 BTC per block; it has now been reduced to 6.25 BTC as of the latest halving in May 2020.

Why Bitcoin’s Scarcity Matters

The limited supply of Bitcoin is a significant factor that influences its value. As more people begin to understand and adopt Bitcoin, the demand may outpace the available supply, driving up prices. In this regard, the scarcity of Bitcoin is often compared to that of gold, which is another finite resource. This characteristic has led many investors to view Bitcoin as a hedge against inflation and economic instability.

Additionally, the decreasing rate of new Bitcoin entering circulation creates a deflationary effect over time. If demand remains high while supply growth slows, the value of existing Bitcoins is likely to increase, further incentivizing early adopters and long-term holders to keep their assets instead of selling them.

The Future of Bitcoin Supply

Looking ahead, the total supply of Bitcoin will become a pivotal topic as we approach 2140 when the final Bitcoin is mined. After this point, no new Bitcoins will enter the market. Transaction fees will then be the primary incentive for miners to maintain the network, which could lead to changes in the dynamics of how Bitcoin is used and perceived.

Many analysts are curious about how the market will react to this transition. Will transaction fees be enough to sustain a healthy network of miners? Duration of miner operation plays a considerable role in the scalability and reliability of the network as well.

In summary, Bitcoin’s existence is limited to a maximum of 21 million coins, out of which nearly 19 million have already been mined. The scarcity created by the capped supply combined with demand dynamics contributes to Bitcoin’s appeal as a digital asset. As we approach the eventual completion of Bitcoin mining, the effects on value, use, and investment strategies will become even more critical to understand.