Bitcoin, Ethereum, Ripple, Bitcoin Cash, Bitcoin SV, Litecoin, EOS, Binance Coin, Tezos, Chainlink: The Cryptocurrencies Explained

In the rapidly evolving world of digital currencies, understanding the main players is essential for both investors and enthusiasts. This article elaborates on the key cryptocurrencies – Bitcoin, Ethereum, Ripple, Bitcoin Cash, Bitcoin SV, Litecoin, EOS, Binance Coin, Tezos, and Chainlink, highlighting their unique features and roles in the cryptocurrency ecosystem.

In the rapidly evolving world of digital currencies, understanding the main players is essential for both investors and enthusiasts. This article elaborates on the key cryptocurrencies – Bitcoin, Ethereum, Ripple, Bitcoin Cash, Bitcoin SV, Litecoin, EOS, Binance Coin, Tezos, and Chainlink, highlighting their unique features and roles in the cryptocurrency ecosystem.

What is Bitcoin?

Bitcoin, often dubbed as the pioneer of cryptocurrencies, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. It operates on a decentralized network and employs blockchain technology, ensuring security and transparency. As the first digital currency, Bitcoin has set the standard for others, emerging as a digital gold in the market.

The Role of Ethereum

Ethereum, launched in 2

015, extends beyond being just a currency; it acts as a platform for decentralized applications (dApps). Its smart contract functionality allows developers to build and deploy their applications on its network, leading to a flourishing ecosystem of services and products.

Understanding Ripple

Ripple focuses on enabling fast and low-cost international payments. Its unique consensus mechanism differentiates it from Bitcoin’s mining process. By partnering with financial institutions, Ripple aims to revolutionize the banking industry, making cross-border transactions seamless and efficient.

Bitcoin Cash and Bitcoin SV

Bitcoin Cash emerged as a fork from Bitcoin in 2

017, increasing block size to allow faster transactions. Meanwhile, Bitcoin SV (Satoshi Vision) further expanded block size and aimed to adhere closely to Nakamoto’s original Vision. Both aim to improve transaction speeds and scalability.

Litecoin: The Silver to Bitcoin’s Gold

Litecoin, created in 2011 by Charlie Lee, is often referred to as ‘the silver to Bitcoin’s gold’. It features a faster block generation time and a different hashing algorithm. With its increased processing speed, Litecoin offers quick transactions, making it attractive for everyday use.

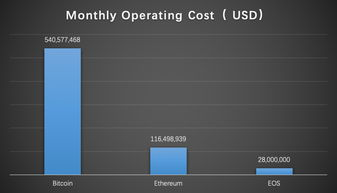

EOS: A Platform for dApps

EOS aims to provide scalability and user-friendliness for dApps. Its delegated proof-of-stake consensus mechanism allows it to handle thousands of transactions per second, offering an attractive environment for developers. EOS’s focus on flexibility and ease of use is enabling its growing traction.

Binance Coin and Its Ecosystem

Binance Coin (BNB) was launched by the Binance cryptocurrency exchange. Initially created to pay for transaction fees on the platform, it has expanded its use case to include trading, travel expenses, and more. Its integration into the Binance ecosystem solidifies its value and utility.

Tezos: A Self-Amending Blockchain

Tezos is unique in its governance model, allowing stakeholders to amend the protocol through on-chain upgrades. This flexibility fosters innovation and adaptation, making it a standout in the blockchain space. Tezos aims to create secure and upgradable smart contracts.

Chainlink’s Oracle Power

Chainlink provides a decentralized oracle network that enables smart contracts to connect with real-world data. This integration is crucial for implementing smart contracts across diverse applications, from finance to supply chain and beyond, promoting interoperability.

In summary, each cryptocurrency plays a pivotal role in the digital economy, catering to various needs from financial transactions to smart contracts and beyond. Understanding these cryptocurrencies’ functionalities not only helps in making informed investment decisions but also sheds light on the future trajectory of digital currencies in our financial landscape.