Litecoin and Bitcoin: A Comprehensive Guide to Two Leading Cryptocurrencies

Cryptocurrencies have revolutionized the financial landscape, with Bitcoin (BTC) and Litecoin (LTC) standing out as two of the most popular options available. Bitcoin, the first cryptocurrency, laid the groundwork for digital currencies, while Litecoin emerged as a prominent alternative, offering distinct features and benefits. In this article, we delve into the similarities and differences between Litecoin and Bitcoin, exploring their technology, use cases, and future prospects.

Cryptocurrencies have revolutionized the financial landscape, with Bitcoin (BTC) and Litecoin (LTC) standing out as two of the most popular options available. Bitcoin, the first cryptocurrency, laid the groundwork for digital currencies, while Litecoin emerged as a prominent alternative, offering distinct features and benefits. In this article, we delve into the similarities and differences between Litecoin and Bitcoin, exploring their technology, use cases, and future prospects.

Overview of Bitcoin

Bitcoin, created by an anonymous person or group known as Satoshi Nakamoto in 2

009, is often referred to as digital gold. It utilizes blockchain technology, ensuring secure, transparent transactions without intermediaries. Bitcoin’s primary use case is as a store of value and a medium of exchange, gaining institutional adoption over the years. Its limited supply of 21 million coins enhances its scarcity, making it an attractive investment option.

Overview of Litecoin

Litecoin, launched in 2011 by Charlie Lee, is often viewed as the silver to Bitcoin’s gold. It is based on Bitcoin’s code but has several differences that aim to improve upon its predecessor. Litecoin features a shorter block generation time, approximately 2.5 minutes compared to Bitcoin’s 10 minutes, which facilitates faster transaction confirmations. This speed makes Litecoin a more practical option for everyday transactions.

Key Differences between Bitcoin and Litecoin

While both cryptocurrencies share a common technological foundation, they diverge in several key areas:

- Transaction Speed: As previously mentioned, Litecoin’s block time is faster, leading to quicker transaction confirmations, which can be advantageous for users seeking efficiency.

- Supply Limit: Bitcoin has a maximum supply of 21 million coins, whereas Litecoin has a higher limit of 84 million coins, which can affect their value dynamics in the long term.

- Mining Algorithm: Bitcoin uses the SHA-256 algorithm for mining, while Litecoin employs Scrypt, which requires different computing resources and impacts the network’s energy consumption.

Use Cases and Adoption

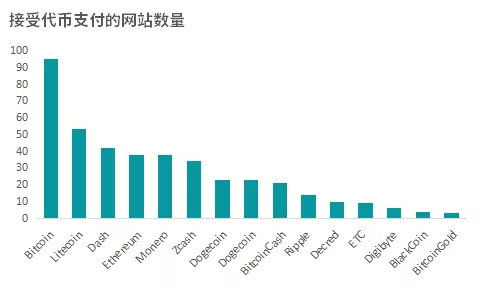

Both Bitcoin and Litecoin have found their niches in the cryptocurrency market. Bitcoin is predominantly used as a store of value, often referred to as “digital gold,” appealing to investors looking for long-term gains and hedges against inflation. Conversely, Litecoin is frequently used for smaller transactions and everyday purchases due to its faster processing times and lower fees. Merchants often prefer Litecoin for its practicality, while Bitcoin is more commonly used for larger value transfers.

The Future of Bitcoin and Litecoin

As the cryptocurrency market evolves, both Bitcoin and Litecoin are poised for growth. Bitcoin’s ongoing institutional adoption and its status as the first cryptocurrency give it significant momentum. On the other hand, Litecoin’s enhancements in transaction speed and fees continue to attract users who prioritize efficiency. Both cryptocurrencies have strong communities and ongoing development, suggesting a promising future for both.

In conclusion, Litecoin and Bitcoin represent two major pillars of the cryptocurrency ecosystem, each with unique characteristics that cater to different segments of users. While Bitcoin remains dominant as a store of value, Litecoin’s advantages position it as a viable option for everyday transactions. Understanding the strengths and weaknesses of each can help investors and users make informed decisions in the dynamic world of cryptocurrencies.