$100 Bitcoin Investment: A Guide to Maximizing Your Profits, Risks, and Strategies

In this article, we will explore the potential of investing $100 in Bitcoin, including strategies to maximize your investment, understanding the risks involved, and how to navigate the cryptocurrency market effectively.

In this article, we will explore the potential of investing $100 in Bitcoin, including strategies to maximize your investment, understanding the risks involved, and how to navigate the cryptocurrency market effectively.

Understanding Bitcoin and Its Market

Bitcoin is a decentralized digital currency that has garnered significant attention since its inception in 2009. As an investment asset, Bitcoin has captured the interest of both new and seasoned investors due to its potential for high returns. When considering a $100 investment in Bitcoin, it’s essential to understand the volatile nature of the cryptocurrency market and how it operates. The intrinsic value of Bitcoin is often linked to supply and demand dynamics, which can lead to substantial price fluctuations.

Investors must be aware of the factors influencing Bitcoin’s price, including market sentiment, regulatory developments, and macroeconomic indicators. Staying informed about these factors will help you make more educated decisions regarding your investment.

Investment Strategies for $100 in Bitcoin

When investing a modest amount like $100 in Bitcoin, it’s crucial to adopt the right strategies to mitigate risks and enhance potential returns. Here are some effective strategies to consider:

This investment strategy involves purchasing a fixed dollar amount of Bitcoin at regular intervals, regardless of its price. Over time, this approach can help average out the cost of your investment and reduce the impact of volatility. For instance, you could invest $20 a week over five weeks.

Given Bitcoin’s historical performance, many investors choose to buy and hold their assets over the long term. By holding onto your $100 investment, you may benefit from potential price appreciation as Bitcoin matures and gains broader adoption.

Understanding the Risks Involved

Investing in Bitcoin carries inherent risks. Price volatility can lead to significant losses, especially in short time frames. Additionally, the cryptocurrency market is still relatively young, and factors such as regulatory changes can dramatically affect prices. It’s important to only invest what you can afford to lose and to maintain realistic expectations about potential gains.

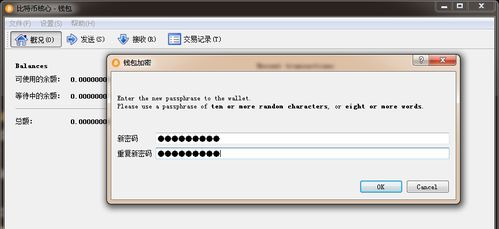

Other risks include security threats such as hacking and fraud. Ensuring that you utilize secure exchanges and wallets can help protect your investment. Consider diversifying your portfolio by not putting all your funds into Bitcoin alone; instead, explore other cryptocurrencies or assets.

In conclusion, a $100 investment in Bitcoin can be a valuable entry point for those looking to start their cryptocurrency journey. By understanding market dynamics, implementing effective investment strategies, and recognizing the associated risks, you can navigate the exciting world of digital currencies more effectively. Make informed decisions and invest wisely to maximize your potential returns.