Digital Currency Trading Platforms, A Comprehensive Guide

In the world of finance, cryptocurrency exchanges play a critical role in facilitating the trading of digital assets. This article explores various types of exchanges, their functionalities, and how they impact the overall cryptocurrency market.

In the world of finance, cryptocurrency exchanges play a critical role in facilitating the trading of digital assets. This article explores various types of exchanges, their functionalities, and how they impact the overall cryptocurrency market.

Understanding Cryptocurrency Exchanges

A cryptocurrency exchange is a digital marketplace where traders can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euro. These platforms offer different services that cater to the diverse needs of traders, making them an essential component of the cryptocurrency ecosystem.

Exchanges can be broadly classified into two categories: centralized (CEX) and decentralized (DEX) exchanges. Centralized exchanges act as intermediaries for trading transactions. They often offer higher liquidity and are generally user-friendly, making them ideal for beginners. In contrast, decentralized exchanges allow peer-to-peer trading without the need for an intermediary, providing users with greater privacy and control over their funds.

Each type of exchange has its own set of advantages and disadvantages that can influence a trader’s experience and success in the market. Understanding these differences is pivotal for anyone looking to trade cryptocurrencies efficiently.

Features of Cryptocurrency Exchanges

Different exchanges offer various features, and recognizing these can guide users in selecting the right platform. Some common features include:

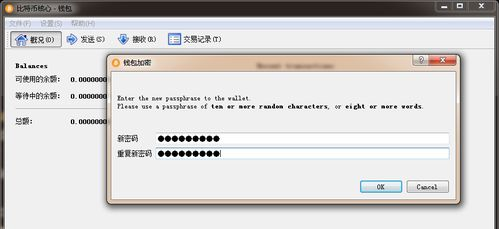

- Security Measures: Security protocols, such as two-factor authentication (2FA) and cold storage, play a crucial role in protecting user funds.

- Trading Pairs: The availability of multiple trading pairs allows traders to diversify their portfolio easily.

- User Interface: A clear and intuitive interface enhances the trading experience, particularly for those who are new to cryptocurrency trading.

- Customer Support: Robust customer support can make a significant difference when issues arise during trading.

It’s essential to compare these features among various exchanges to find one that aligns with individual trading goals and experience levels.

The Impact of Cryptocurrency Exchanges on the Market

Cryptocurrency exchanges significantly impact market liquidity and price discovery. The level of activity on these platforms directly influences the overall market trends. High trading volumes on exchanges can lead to increased price fluctuations, while lower volumes may result in a more stable market condition.

Moreover, the regulatory environment surrounding exchanges can affect their operation and the trading landscape. As governments implement regulations to control cryptocurrency trading, exchanges must adapt to ensure compliance, which may influence their operations and prices.

In conclusion, cryptocurrency exchanges are vital to the growth and dynamics of the digital asset economy. They provide the necessary infrastructure for trading and contribute to overall market resilience. By understanding the different types of exchanges, their features, and their market impact, traders can make informed decisions, thus enhancing their trading proficiency.