Bitcoin ETF Updates, Latest Insights

The world of Bitcoin ETFs (Exchange-Traded Funds) continues to evolve, reflecting significant changes in regulations, market dynamics, and investor sentiment. This article delves into the most recent news surrounding Bitcoin ETFs and their implications for the cryptocurrency market.

The world of Bitcoin ETFs (Exchange-Traded Funds) continues to evolve, reflecting significant changes in regulations, market dynamics, and investor sentiment. This article delves into the most recent news surrounding Bitcoin ETFs and their implications for the cryptocurrency market.

Current Bitcoin ETF Developments

The landscape of Bitcoin ETFs has dramatically shifted over the past year, driven by adjustments in regulatory attitudes and increasing demand from institutional investors. Recently, the U.S. Securities and Exchange Commission (SEC) has reviewed multiple applications from various financial institutions seeking to launch Bitcoin ETFs. Their decisions have been highly anticipated as they can impact Bitcoin’s price and market perception.

In recent months, there have been reports of potential approvals or rejections of Bitcoin ETF applications, sparking considerable interest across the financial community. Companies like BlackRock and Fidelity have been in the spotlight, with their applications gaining traction. Analysts are closely observing how these developments could influence the overall cryptocurrency market.

Investors’ Reactions to Bitcoin ETF News

Investors are closely monitoring Bitcoin ETF news as it can serve as a barometer for institutional adoption of cryptocurrencies. The potential for mainstream acceptance via ETFs is significant, as these financial products could make Bitcoin more accessible to ordinary investors who prefer the traditional stock market trading environment.

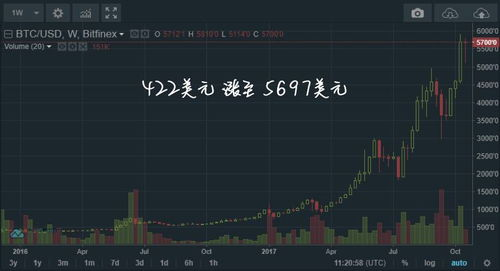

Whenever news breaks regarding potential ETF approvals or rejections, significant price fluctuations in Bitcoin often follow. The market response to these announcements highlights the growing integration of cryptocurrencies into traditional financial frameworks, which could lead to increased legitimacy and stability for Bitcoin overall.

Challenges and Considerations

Despite the enthusiasm surrounding Bitcoin ETFs, various challenges continue to loom. Regulatory hurdles remain a significant concern, with the SEC striving to address market manipulation and investor protection before allowing ETFs to enter the market. Moreover, the overall economic climate can also impact investor sentiment and regulatory decisions.

Market analysts suggest that achieving a balanced regulatory approach that fosters innovation while ensuring investor safety is paramount. Observers believe that a well-regulated Bitcoin ETF market could pave the way for additional cryptocurrency investments, deeply influencing the future of digital assets.

In summary, the realm of Bitcoin ETFs is dynamic, with constant news updates that shape the cryptocurrency market. The anticipation of ETF approvals plays a critical role in influencing investor behavior and market trends. As the situation evolves, staying informed on the latest developments is essential for anyone engaged in Bitcoin investment.