Cryptocurrency Trading, Strategies and Insights

In today\’s digital age, trading cryptocurrencies like Bitcoin has become increasingly popular among investors and traders alike. This article aims to provide comprehensive insights into cryptocurrency trading, focusing on strategies, tools, and key concepts that can help both novices and experienced traders in their trading journey.

In today’s digital age, trading cryptocurrencies like Bitcoin has become increasingly popular among investors and traders alike. This article aims to provide comprehensive insights into cryptocurrency trading, focusing on strategies, tools, and key concepts that can help both novices and experienced traders in their trading journey.

Understanding Cryptocurrency Trading

Cryptocurrency trading involves the buying and selling of digital currencies on various platforms. Unlike traditional stock trading, cryptocurrency markets operate 24/

7, providing traders with opportunities to engage at any time. Bitcoin, being the first and most widely recognized cryptocurrency, often serves as a benchmark for evaluating the cryptocurrency market.

Key Concepts in Trading

To successfully navigate cryptocurrency trading, it’s essential to grasp several key concepts:

- Volatility: Cryptocurrencies are notorious for their price volatility, which can lead to significant profits or losses in a short period.

- Market Orders vs. Limit Orders: Traders can place market orders, which execute instantly at current prices, or limit orders, which allow traders to set a specific price for buying or selling.

- Trading Pairs: Bitcoin trades against various other cryptocurrencies or fiat currencies. Understanding trading pairs is crucial for effective trading.

Strategies for Successful Trading

Adopting effective trading strategies can enhance your chances of success in the volatile crypto market:

- Day Trading: This involves making multiple trades within a day, capitalizing on small price movements.

- Swing Trading: Traders hold onto assets for a few days or weeks, aiming to profit from expected price shifts.

- HODLing: A long-term strategy where traders buy cryptocurrencies like Bitcoin and hold them despite market fluctuations, with the belief that the price will eventually rise.

Tools for Trading

Utilizing the right tools can also improve trading performance:

- Charting Software: Tools like TradingView provide advanced charting capabilities to analyze price trends and patterns.

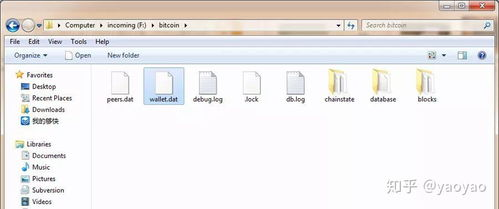

- Crypto Wallets: Secure wallets are essential for storing your cryptocurrencies. Hardware wallets are often recommended for their enhanced security features.

- News Aggregators: Staying updated with market news can impact trading decisions significantly.

Risks in Cryptocurrency Trading

While cryptocurrency trading can be lucrative, it comes with risks. Factors like regulatory changes, market manipulation, and technological vulnerabilities can affect prices unpredictably. Therefore, risk management practices such as stop-loss orders and diversifying your portfolio are vital to mitigate potential losses.

In summary, cryptocurrency trading, particularly with Bitcoin, offers exciting opportunities but also requires a solid understanding of market dynamics, strategies, and risk management. By leveraging the right tools and keeping up with market trends, traders can navigate this volatile landscape effectively.