Market Bitcoin Transactions, Trading, and Selling Strategies

In the rapidly evolving world of cryptocurrencies, understanding how to sell bitcoins effectively is crucial for investors and traders alike. This article will delve into various strategies for selling bitcoins, focusing on market dynamics, trading tips, and the different platforms available for converting your digital assets into cash or other cryptocurrencies.

In the rapidly evolving world of cryptocurrencies, understanding how to sell bitcoins effectively is crucial for investors and traders alike. This article will delve into various strategies for selling bitcoins, focusing on market dynamics, trading tips, and the different platforms available for converting your digital assets into cash or other cryptocurrencies.

Understanding Bitcoin Sales

Selling bitcoins involves converting your cryptocurrency into fiat money or different digital assets. This process can occur through various platforms, including cryptocurrency exchanges, peer-to-peer trading platforms, or Bitcoin ATMs. It’s essential to grasp the specific mechanics behind these selling methods to ensure a seamless transaction, maximize profit, and minimize risks.

To successfully sell bitcoins, it is vital to monitor the market dynamics. Prices fluctuate due to various factors, including market demand, regulatory news, and economic developments. Keeping an eye on market trends helps sellers decide the optimal time for transaction.

Using Cryptocurrency Exchanges

Cryptocurrency exchanges are the most common platforms for selling bitcoins. These platforms allow users to create accounts, deposit bitcoins, and place sell orders. Some of the leading exchanges include Binance, Coinbase, and Kraken. Each of these platforms offers unique features, fees, and security measures, so it’s important to conduct thorough research to select the one that best suits your needs.

When using exchanges, remember there are typically two types of sell orders: market orders and limit orders. A market order allows you to sell bitcoins immediately at the current market price, while a limit order lets you specify the price at which you’re willing to sell. This flexibility enables sellers to maximize their profits based on market conditions.

Peer-to-Peer Trading Platforms

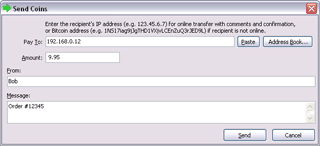

Another option for selling bitcoins is through peer-to-peer (P2P) trading platforms, such as LocalBitcoins or Paxful. P2P platforms allow users to connect directly with buyers, negotiate prices, and complete transactions without the need for a centralized exchange.

Using P2P platforms often comes with added benefits, such as higher privacy levels and the potential for lower fees. However, with these perks come risks, such as the possibility of scams. It’s crucial to conduct due diligence on potential buyers and use the platform’s escrow services to secure your transaction.

Bitcoin ATMs and Other Selling Methods

Bitcoin ATMs also offer a convenient way to sell bitcoins. These machines allow users to sell their bitcoins and receive cash instantly. However, be aware that transaction fees at Bitcoin ATMs can be significantly higher than those on exchanges or P2P platforms.

Additionally, some individuals may opt to sell bitcoins through direct sales to friends or family members. This method can eliminate fees associated with exchanges or ATM transactions but requires establishing trust and ensuring secure payment methods.

In summary, selling bitcoins can be accomplished through various methods, including cryptocurrency exchanges, peer-to-peer trading platforms, and Bitcoin ATMs. Each method has its advantages and disadvantages, so understanding your options and market dynamics is key to making informed decisions in your bitcoin selling strategies. By staying vigilant and methodical, you can navigate the cryptocurrency landscape effectively and maximize your returns.