Cryptocurrency Sales, Understanding the Dynamics of Bitcoin Transactions

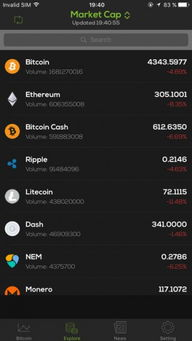

The rise of Bitcoin has revolutionized the financial landscape, becoming a prominent cryptocurrency in today\’s market. This article will delve into the intricacies of cryptocurrency sales, specifically focusing on Bitcoin transactions, their relevance, and the factors influencing their dynamics.

The rise of Bitcoin has revolutionized the financial landscape, becoming a prominent cryptocurrency in today’s market. This article will delve into the intricacies of cryptocurrency sales, specifically focusing on Bitcoin transactions, their relevance, and the factors influencing their dynamics.

What Influences Bitcoin Sales?

Bitcoin sales are affected by various factors, including market demand, regulatory environments, technological advancements, and investor sentiment. Each of these elements plays a significant role in determining the value of Bitcoin and, consequently, the volume of sales.

Market demand is perhaps the most significant factor influencing Bitcoin sales. As more individuals and institutions invest in Bitcoin, the demand spikes, leading to increased sales. The perception of Bitcoin as a store of value, especially during economic uncertainty, motivates investors to buy, driving sales figures higher.

Regulatory frameworks also have a substantial impact on Bitcoin sales. Countries with supportive regulations tend to see higher sales volumes, while restrictive environments may hinder potential investors. The evolving nature of regulations contributes to the uncertainty surrounding Bitcoin, affecting how consumers and businesses engage in transactions.

Technological Impact on Bitcoin Transactions

Technological advancements have significantly transformed the landscape of Bitcoin transactions. The introduction of wallets, exchanges, and payment processors has simplified buying and selling Bitcoin, leading to an increase in sales. Moreover, as technology improves, so does security, which reassures investors and boosts sales confidence.

In addition to technological advancements, the scalability of the Bitcoin network is crucial. As the network becomes more efficient in processing transactions, it enhances the sales experience, attracting more users to engage in buying and selling Bitcoin. Solutions such as the Lightning Network represent efforts to improve scalability, thus promoting sales growth.

Investor Sentiment and Its Effects

Investor sentiment can have pronounced effects on Bitcoin sales. Positive news and bullish market conditions tend to drive sales upward, while negative sentiment, often fueled by market corrections or unfavorable news, can substantially decrease sales volumes. Traders and investors often react quickly to market signals, contributing to the volatility of Bitcoin sales.

In this context, social media and news outlets play a pivotal role as they influence investor perception. The speed at which information circulates can lead to rapid changes in demand, drastically affecting sales statistics.

In conclusion, the dynamics of Bitcoin sales are shaped by an interplay of market demand, regulatory influences, technological advancements, and investor sentiment. Understanding these elements is crucial for anyone looking to navigate the cryptocurrency landscape successfully. Whether you are an investor, a trader, or simply curious about Bitcoin, recognizing how these factors impact sales can enhance your comprehension of the cryptocurrency market.