Bitcoin, Digital Currency Revolutionizing Finance

In recent years, Bitcoin has emerged as a revolutionary digital currency that has transformed the landscape of finance and investment. This article will delve into the intricacies of Bitcoin, exploring its origins, functionality, advantages, and the challenges it faces in today’s economy.

In recent years, Bitcoin has emerged as a revolutionary digital currency that has transformed the landscape of finance and investment. This article will delve into the intricacies of Bitcoin, exploring its origins, functionality, advantages, and the challenges it faces in today’s economy.

The Origin of Bitcoin

Bitcoin, conceived in 2008 by an anonymous entity known as Satoshi Nakamoto, was introduced to the world through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The fundamental goal behind Bitcoin was to create a decentralized digital currency that would allow for peer-to-peer transactions without the need for intermediaries such as banks.

How Bitcoin Works

The operation of Bitcoin relies on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous one, forming a chain. This process ensures transparency and security as each block is cryptographically secured and can only be altered with the consensus of the network members.

Advantages of Using Bitcoin

One of the significant advantages of Bitcoin is its ability to operate without country-specific regulations, making it a global currency. Additionally, Bitcoin transactions are relatively fast and cost-effective, bypassing traditional banking fees. Its decentralized nature also means that users have complete control over their funds, reducing the risk of government interference.

Challenges and Risks

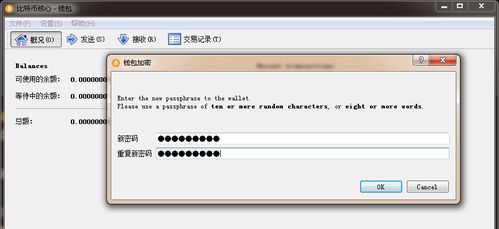

Despite its benefits, Bitcoin faces numerous challenges. The volatility of its price can be a major deterrent for potential investors. Furthermore, Bitcoin and other cryptocurrencies are often associated with illegal transactions, which can lead to regulatory scrutiny. Another concern is related to cybersecurity risks; as evident from numerous high-profile hacks that have targeted exchanges and wallets.

In summary, Bitcoin has significantly impacted the financial world by offering a new form of digital currency that promotes decentralization, security, and transparency. However, like any financial instrument, it comes with its set of challenges that need to be addressed as the technology continues to evolve. The future of Bitcoin is uncertain, but its potential remains a topic of ongoing interest and debate in the financial community.