Digital Currency Trading Platform: Understanding Cryptocurrency Exchange

In recent years, cryptocurrency exchanges have become pivotal in the world of digital finance, enabling users to trade various cryptocurrencies with ease. This article explores what a cryptocurrency exchange is, how it functions, and the different types available.

In recent years, cryptocurrency exchanges have become pivotal in the world of digital finance, enabling users to trade various cryptocurrencies with ease. This article explores what a cryptocurrency exchange is, how it functions, and the different types available.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform that facilitates the buying, selling, and trading of cryptocurrencies. These exchanges act as intermediaries between buyers and sellers and serve as a marketplace where participants can exchange traditional fiat currencies for cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The rapid growth of cryptocurrencies has led to the emergence of numerous exchanges that cater to a global market.

Exchanges typically charge a fee for each transaction, and they may also offer additional services such as wallet creation and management, trading tools, and market analysis. This integration of features makes them essential for both novice and experienced investors in the cryptocurrency space.

How Do Cryptocurrency Exchanges Work?

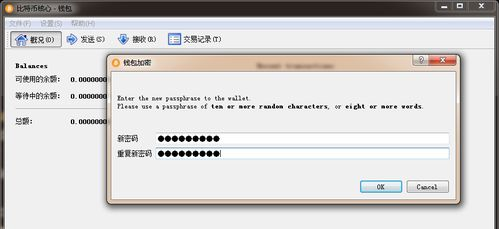

Understanding how cryptocurrency exchanges operate is crucial for anyone looking to dive into digital asset trading. Most exchanges operate on a simple system where users create accounts, deposit funds, and start trading. After signing up, users can deposit fiat currency (like USD or EUR) or cryptocurrencies into their accounts.

Once the funds are available, users can place buy or sell orders for various cryptocurrencies. The exchange matches these orders from different users, ensuring that transactions are executed efficiently. Prices of cryptocurrencies change dynamically based on market demand, so traders can capitalize on price fluctuations.

Types of Cryptocurrency Exchanges

There are several primary types of cryptocurrency exchanges, each catering to different needs:

- Centralized Exchanges (CEX): These are the most common types of exchanges. They are run by private companies that manage the trading platform and facilitate order matching. Examples include Binance and Coinbase.

- Decentralized Exchanges (DEX): In contrast to centralized exchanges, DEXs operate without a central authority. They enable peer-to-peer transactions directly between users through blockchain technology. Examples include Uniswap and SushiSwap.

- Peer-to-Peer (P2P) Exchanges: P2P exchanges connect buyers and sellers directly, allowing them to negotiate terms and execute trades without intermediaries. Examples include LocalBitcoins and Paxful.

Each type of exchange has its own pros and cons regarding security, fees, and user experience, so choosing the right one is vital for a successful trading experience.

In conclusion, cryptocurrency exchanges serve as crucial gateways for trading digital currencies. By offering a variety of services, understanding different exchange types, and facilitating smooth transactions, they play a vital role in the adoption and growth of cryptocurrencies. Whether you are a beginner or an experienced trader, knowing how these platforms work will empower you to navigate the digital asset landscape effectively.