Bitcoin: A Comprehensive Guide to the Digital Currency

In this article, we will explore Bitcoin, an innovative form of digital currency that has gained significant popularity and attention over the years. From its inception to its current status in the financial world, we will provide an in-depth understanding of this cryptocurrency and its various implications.

In this article, we will explore Bitcoin, an innovative form of digital currency that has gained significant popularity and attention over the years. From its inception to its current status in the financial world, we will provide an in-depth understanding of this cryptocurrency and its various implications.

What is Bitcoin?

Bitcoin is a decentralized form of digital currency that was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Unlike traditional currencies, Bitcoin operates on a peer-to-peer network, allowing users to make transactions directly with one another without the need for a central authority or intermediary, such as a bank. This independence from government control is one of the key features that attracts users to Bitcoin.

The Technology Behind Bitcoin

At the core of Bitcoin is blockchain technology. A blockchain is a public ledger that records all transactions made with Bitcoin. Each transaction is grouped into a block, and these blocks are linked together in chronological order, forming a chain. This not only ensures transparency but also secures the network against fraud and hacking, as altering any information on the blockchain would require changing all subsequent blocks, which is practically impossible due to the network’s decentralized nature.

How to Acquire Bitcoin

There are several methods to acquire Bitcoin. One common way is through cryptocurrency exchanges, where users can buy Bitcoin using traditional currency. Additionally, users can earn Bitcoin by providing goods or services, or by mining, which involves using powerful computers to solve complex mathematical problems that validate transactions on the network. However, mining requires significant computational power and electricity, making it less accessible for the average user.

The Benefits and Risks of Bitcoin

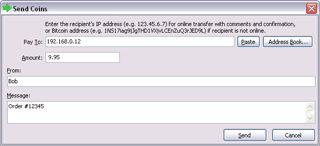

Bitcoin offers various benefits, such as low transaction fees, privacy, and portability. Users enjoy the ability to send money quickly and efficiently across the globe without the high costs often associated with banks or financial institutions. However, there are also risks to consider. The price of Bitcoin is highly volatile, which can lead to significant gains or losses in a short period. Additionally, the lack of regulation can expose users to potential scams and fraudulent activities.

The Future of Bitcoin

As Bitcoin continues to evolve, its acceptance as a legitimate form of payment is gradually increasing. Many businesses and online platforms are now accepting Bitcoin as payment for goods and services, further integrating it into the mainstream economy. However, the future of Bitcoin will depend largely on regulatory developments, technological advancements, and market adoption.

In summary, Bitcoin represents a groundbreaking advancement in the world of finance. As a decentralized currency built on blockchain technology, it offers unique advantages and faces certain challenges. Understanding how Bitcoin works and its potential implications is crucial for anyone looking to navigate the digital currency landscape.