Bitcoin Earnings Tax, Understanding Cryptocurrency Tax Implications

The landscape of cryptocurrency investments has expanded rapidly, bringing about significant financial opportunities and challenges. One crucial aspect to consider for investors is the capital gains tax implications associated with Bitcoin and other cryptocurrencies. This article delves into the concept of Bitcoin earnings tax, examining its relevance, how it works, and the strategies for effective tax management.

The landscape of cryptocurrency investments has expanded rapidly, bringing about significant financial opportunities and challenges. One crucial aspect to consider for investors is the capital gains tax implications associated with Bitcoin and other cryptocurrencies. This article delves into the concept of Bitcoin earnings tax, examining its relevance, how it works, and the strategies for effective tax management.

What is Capital Gains Tax?

Capital gains tax is a tax on the profit realized from the sale of non-inventory assets. In the case of Bitcoin, if you purchase Bitcoin and later sell it at a higher price, the profit you make is subject to capital gains tax. Understanding this tax is vital for anyone involved in cryptocurrency trading, as it directly impacts your overall investment returns.

When discussing Bitcoin earnings tax, it’s essential to differentiate between short-term and long-term capital gains. Short-term capital gains apply to assets held for one year or less and are taxed at ordinary income rates, while long-term capital gains apply to assets held for more than one year and typically have lower tax rates.

How Bitcoin Capital Gains Tax Works

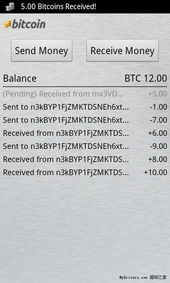

To grasp the concept of Bitcoin earnings tax, investors must consider the method of acquiring and disposing of their Bitcoin. When you sell, trade, or use Bitcoin for purchases, each of these actions can trigger a taxable event. Let’s explore how these transactions can affect capital gains tax:

For example, if you bought 1 Bitcoin at

$10,000 and sold it at

$15,

000, your capital gain would be

$5,000. This amount will determine the tax you owe.

For instance, if you trade Bitcoin for Ethereum, the IRS treats this as if you sold your Bitcoin. Hence, the gains or losses from the trade must also be reported for tax purposes.

For example, if you use Bitcoin worth

$1,000 to buy a product and its value had increased to

$1,200 since you purchased it, you would need to report a $200 gain.

Strategies for Managing Bitcoin Capital Gains Tax

Bitcoin investors should be proactive in managing their tax implications. Here are some strategies to consider:

This approach may require a patience-based strategy, but it can significantly reduce your tax liability over time.

If you have experienced losses with other investments, consider selling those assets to realize a loss, which can offset gains made in Bitcoin.

Maintaining detailed records of purchase prices, sale prices, and transaction dates can simplify tax reporting and ensure that you pay only what you owe.

In conclusion, understanding Bitcoin earnings tax is vital for investors looking to navigate the complex landscape of cryptocurrency investments. By being aware of how capital gains tax applies to Bitcoin transactions and employing effective tax management strategies, investors can maximize their returns while staying compliant with tax regulations. Always consult a tax professional for personalized advice regarding your unique situation.