Bitcoin Mini Shares: Understanding the Latest Investment Trend, Benefits, and Risks

Bitcoin mini shares have emerged as a fascinating investment possibility in the fast-growing cryptocurrency market. This article explores what Bitcoin mini shares are, along with their benefits and potential risks.

Bitcoin mini shares have emerged as a fascinating investment possibility in the fast-growing cryptocurrency market. This article explores what Bitcoin mini shares are, along with their benefits and potential risks.

What are Bitcoin Mini Shares?

Bitcoin mini shares are essentially fractionalized ownership of Bitcoin, allowing investors to hold smaller portions of the cryptocurrency rather than purchasing a complete Bitcoin. This option offers an accessible entry point for retail investors who might find the price of a full Bitcoin prohibitive given its current market valuation.

By trading Bitcoin mini shares, investors can expose themselves to the performance of Bitcoin without needing a large capital outlay. The shares are usually traded on exchanges and can fluctuate in value, just like traditional stock shares, making them a compelling investment vehicle for a broad range of investors.

Benefits of Investing in Bitcoin Mini Shares

One of the main advantages of Bitcoin mini shares is accessibility. Many investors may be intimidated by the high price of a single Bitcoin, which can be thousands of dollars. With mini shares, a person can buy a fraction, thus democratizing access to the cryptocurrency market. This enables more individuals to participate in the investing landscape.

Another benefit is liquidity. Since Bitcoin mini shares can be traded on regular stock exchanges, investors can buy and sell them without the need to navigate specialized cryptocurrency exchanges. This streamlined process can attract new retail investors who are familiar with stock trading but less comfortable with the broader cryptocurrency ecosystem.

Moreover, these shares often provide a level of diversification. Investors can buy mini shares without committing to one asset entirely. This means they can balance their portfolios and mitigate risk by investing in various cryptocurrencies alongside traditional assets.

Potential Risks Involved with Bitcoin Mini Shares

However, like all investments, Bitcoin mini shares come with their own set of risks. The cryptocurrency market is notorious for its volatility. Prices can swing dramatically in a short amount of time, and investors may face significant losses if the market trends downward quickly.

Additionally, regulatory uncertainties surrounding cryptocurrencies can pose risks to investors. Governments around the world are still in the process of establishing frameworks for how cryptocurrencies should be regulated, and changes in regulations can impact the value of Bitcoin and related investment products, including mini shares.

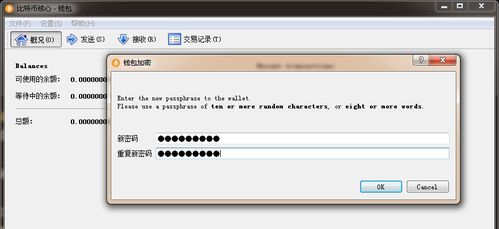

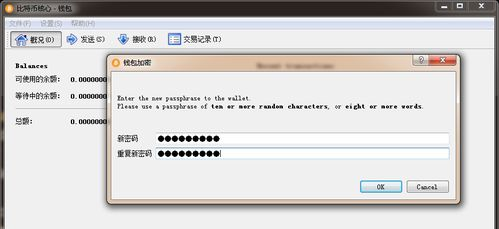

Lastly, there are concerns regarding security and fraud, particularly for investors who might lack familiarity with the nuances of cryptocurrency trading. As with any investment, conducting thorough research and consulting financial advisors can be beneficial in navigating these challenges.

In conclusion, Bitcoin mini shares present an intriguing opportunity for individuals looking to engage with the growing cryptocurrency market. With benefits such as accessibility and liquidity come risks that investors should weigh carefully before diving in. By understanding both the potential rewards and the pitfalls, investors can better navigate this evolving landscape.