Bitcoin vs Ripple, Understanding the Key Differences

In the world of cryptocurrencies, two names often come up in discussions: Bitcoin (BTC) and Ripple (XRP). This article will delve into the fundamental differences between these two cryptocurrencies, their purposes, technologies, and market roles.

In the world of cryptocurrencies, two names often come up in discussions: Bitcoin (BTC) and Ripple (XRP). This article will delve into the fundamental differences between these two cryptocurrencies, their purposes, technologies, and market roles.

Purpose of Bitcoin and Ripple

Bitcoin, created in 2009 by an anonymous person or group known as Satoshi Nakamoto, was designed as a digital alternative to traditional currencies. Its primary purpose is to serve as a decentralized money system, allowing peer-to-peer transactions without the need for intermediaries. Conversely, Ripple, introduced in 2012 by Ripple Labs, aims to facilitate fast and low-cost international money transfers for banks and financial institutions. While Bitcoin focuses on becoming a form of money, Ripple is more about enhancing the current financial infrastructure.

Technology and Network Protocols

The underlying technology of Bitcoin is the blockchain, a decentralized ledger that records all transactions. Bitcoin’s network relies on a consensus mechanism known as Proof of Work, which requires miners to solve complex puzzles to validate transactions. On the other hand, Ripple utilizes a consensus protocol called the Ripple Protocol Consensus Algorithm (RPCA

), which allows for faster transaction processing by having trusted validators verify the validity of transactions. This difference in technology results in Bitcoin transactions usually taking longer and costing more compared to Ripple.

Supply and Market Behavior

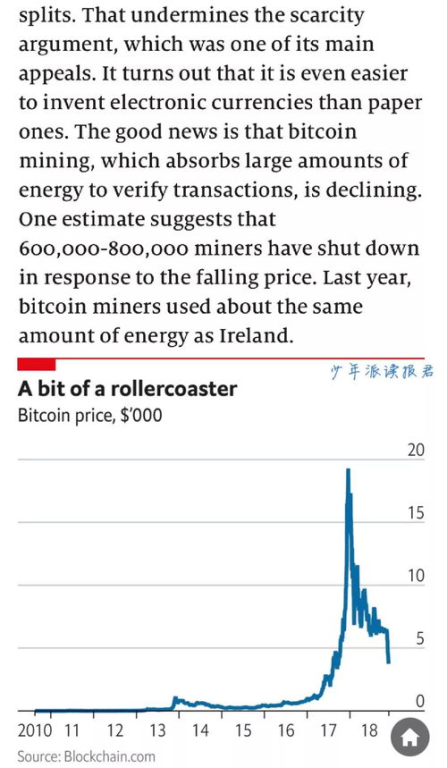

Bitcoin has a capped supply of 21 million coins, which contributes to its scarcity and is a pivotal part of its value proposition. Additionally, Bitcoin is often viewed as a store of value or “digital gold.” In contrast, Ripple has an initial supply of 100 billion XRP tokens, with a significant portion held by Ripple Labs. The nature of Ripple’s centralized supply has drawn criticism, but it allows Ripple to maintain control over the token’s value and utility in payments. This flexibility can lead to greater volatility in price for XRP compared to BTC.

Market Adoption and Use Cases

Bitcoin is widely accepted across numerous platforms and has become synonymous with cryptocurrency, attracting individual investors and retail users. Its use case primarily revolves around investment and store of value, while it also serves as a medium for decentralized applications. On the flip side, Ripple is primarily adopted by financial institutions and payment providers seeking to enhance their cross-border payment solutions. Its technology allows for near-instant settlement times, making it a preferred choice for banks.

In summary, Bitcoin and Ripple represent different approaches within the cryptocurrency ecosystem. While Bitcoin focuses on creating an alternative currency for general use, Ripple targets enhancing existing financial systems for businesses and institutions. Understanding these differences can help investors and users make informed decisions about their cryptocurrency engagements.