Farside Bitcoin Exchange-Traded Fund, Understanding Its Impact

In recent years, cryptocurrency investment has gained significant traction, particularly with instruments like Bitcoin Exchange-Traded Funds (ETFs). Among various offerings, the Farside Bitcoin ETF stands out, providing unique opportunities and challenges. This article delves into the implications, benefits, and considerations surrounding the Farside BTC ETF.

In recent years, cryptocurrency investment has gained significant traction, particularly with instruments like Bitcoin Exchange-Traded Funds (ETFs). Among various offerings, the Farside Bitcoin ETF stands out, providing unique opportunities and challenges. This article delves into the implications, benefits, and considerations surrounding the Farside BTC ETF.

What Is a Bitcoin ETF?

A Bitcoin ETF is a type of investment fund that tracks the price of Bitcoin and allows investors to buy shares in the fund, rather than buying Bitcoin directly. This can make it easier for investors to gain exposure to Bitcoin’s price movements without the complexities of managing digital assets. The Farside Bitcoin ETF, in particular, aims to offer a streamlined and regulated investment vehicle in the volatile crypto market.

Benefits of the Farside Bitcoin ETF

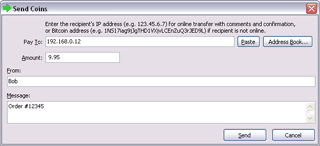

Investing in the Farside Bitcoin ETF provides several notable advantages. First, it allows for simpler access to Bitcoin investments for traditional investors. With a regular brokerage account, investors can acquire shares of the ETF without needing a cryptocurrency wallet.

Furthermore, the ETF structure may entail lower management fees compared to some other investment products. This can lead to cost savings for investors who are looking for long-term exposure to Bitcoin.

Market Implications of Farside BTC ETF

The introduction of the Farside BTC ETF might also influence the overall cryptocurrency market. As more institutional investors adopt Bitcoin as a formal investment through ETFs, it may result in heightened legitimacy and stability in the cryptocurrency space. This can potentially lead to increased market adoption and a more mature investment environment.

Moreover, the presence of a regulated ETF might attract conservative investors who were previously hesitant to engage with crypto markets due to regulatory uncertainties.

Risks and Considerations

Despite the benefits, investors should be aware of the inherent risks associated with the Farside Bitcoin ETF. The volatility of Bitcoin prices can lead to significant price swings, and investors may experience profound losses despite their structured approach to investment.

Additionally, there may be tracking errors, meaning the ETF’s performance could deviate from Bitcoin’s actual market performance. Investors should carefully review the ETF’s structure and fees to understand how these factors may affect returns.

In conclusion, the Farside Bitcoin ETF presents an intriguing option for investors seeking exposure to Bitcoin without directly buying the cryptocurrency. While it offers benefits such as ease of access and potential regulatory compliance, it is crucial for investors to consider the risks involved. As the cryptocurrency market continues to evolve, staying informed about products like the Farside Bitcoin ETF is essential for making informed investment decisions.