Small Bitcoin Holdings: Understanding Tiny Investments in Cryptocurrency

In the realm of digital currencies, even small amounts like 0.00004000000000 BTC can represent significant opportunities for investors. This article delves into the implications of holding small quantities of Bitcoin and how these tiny investments can fit into a broader financial strategy.

In the realm of digital currencies, even small amounts like 0.00004000000000 BTC can represent significant opportunities for investors. This article delves into the implications of holding small quantities of Bitcoin and how these tiny investments can fit into a broader financial strategy.

What is Bitcoin?

Bitcoin, the pioneering cryptocurrency, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. It operates on a decentralized network using blockchain technology, which ensures secure transactions. The attractiveness of Bitcoin lies in its digital scarcity, mathematical algorithms that limit its supply, and its potential as a store of value.

Understanding Tiny Amounts of Bitcoin

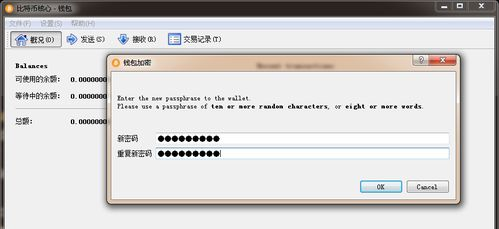

The amount of 0.00004000000000 BTC may seem negligible, but it is important to recognize what it represents. Bitcoin is divisible up to eight decimal places, which means even a fraction of one whole Bitcoin can be traded, used for transactions, or held as an investment. This feature enables investors to engage with Bitcoin without having to purchase whole units, making it accessible to a broader audience.

For instance, with the current value of Bitcoin fluctuating significantly, even small amounts can appreciate. Holding tiny fractions can accumulate over time, especially if the price of Bitcoin rises. This underscores the importance of considering not just the whole Bitcoin’s value but also how fractional investments can contribute to potential wealth building.

Benefits of Holding Small Amounts of Bitcoin

Investing small amounts of Bitcoin can provide several advantages:

- Accessibility: Individuals can start investing in cryptocurrency without significant financial risk.

- Diversification: Small investments allow diversification across various cryptocurrencies and other asset classes.

- Educational Experience: New investors can familiarize themselves with the mechanics of cryptocurrency trading and the market dynamics with minimal exposure.

Furthermore, platforms for buying and trading Bitcoin typically allow fractional purchases, enhancing this accessibility. Users can easily buy a portion of Bitcoin for as little as a few cents, making it easier to experiment with investing strategies in the cryptocurrency space.

The Future of Cryptocurrency and Tiny Investments

As the cryptocurrency market evolves, the appeal of investing in tiny fractions of Bitcoin may grow. Speculation about Bitcoin’s role in the future economy, its adoption by institutions, and regulatory developments can influence its price trajectory. Small investors should always perform thorough research and stay updated on market trends to make informed decisions regarding their investments.

In summary, even a small Bitcoin holding like 0.00004000000000 BTC represents an opportunity to enter the cryptocurrency market and potentially benefit from future price fluctuations. As more people become interested in digital currencies, the ability to invest in small amounts opens doors for education, diversification, and financial growth opportunities.