Bitcoin Trading Bots, Revolutionizing Cryptocurrency Investments

In the world of cryptocurrency trading, automation plays a crucial role in maximizing profits and minimizing risks. Bitcoin trading bots have emerged as vital tools for both novice and experienced traders, enhancing their investment strategies through automated processes. This article delves into the significance of Bitcoin trading bots, their functionalities, advantages, drawbacks, and how they can transform the trading landscape.

In the world of cryptocurrency trading, automation plays a crucial role in maximizing profits and minimizing risks. Bitcoin trading bots have emerged as vital tools for both novice and experienced traders, enhancing their investment strategies through automated processes. This article delves into the significance of Bitcoin trading bots, their functionalities, advantages, drawbacks, and how they can transform the trading landscape.

What are Bitcoin Trading Bots?

Bitcoin trading bots are software programs that automate the buying and selling of Bitcoin on behalf of traders. These bots use algorithms to analyze market data, execute trades, and manage portfolios based on predefined parameters. By leveraging technology, traders can operate efficiently, especially in the fast-paced crypto market.

How Do They Work?

Bitcoin trading bots work by connecting to an exchange via an API (Application Programming Interface). Once connected, they can monitor the market conditions and execute trades automatically according to the user’s specified trading strategies. Some bots utilize technical analysis, sentiment analysis, or a blend of both to inform their trading decisions, ensuring they maintain a competitive edge in the market.

Advantages of Using Bitcoin Trading Bots

One of the primary advantages of Bitcoin trading bots is the ability to trade 24/7 without the need for constant human oversight. This capacity allows traders to seize market opportunities at any time, even during off-hours. Furthermore, bots can execute trades more swiftly than humans, which can be essential during volatile price movements.

Additionally, bots eliminate emotional trading, which can lead to rash decisions and potential losses. By sticking strictly to an established strategy, bots provide discipline and consistency in trading activities. They can also backtest strategies using historical data, allowing traders to refine their techniques before deploying them in real-time scenarios.

Drawbacks of Bitcoin Trading Bots

Despite their numerous benefits, Bitcoin trading bots are not without their drawbacks. One significant concern is the reliance on algorithms that might not always adapt to rapidly changing market conditions. If market dynamics shift unexpectedly, bots may incur losses if they are not programmed to handle such situations effectively.

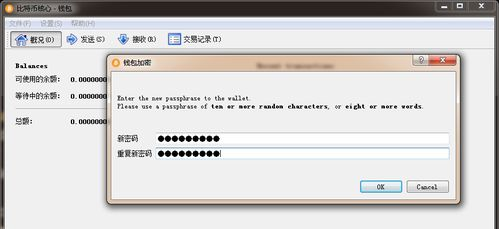

Moreover, the performance of a trading bot is largely dependent on the trading strategy that users implement. Without a solid strategy, even the most advanced bots can result in poor trading performance. Furthermore, users must also consider the security risks involved, as connecting bots to exchanges may expose accounts to potential hacks or scams if not handled correctly.

Conclusion

In summary, Bitcoin trading bots have transformed how individuals trade cryptocurrencies by automating the processes involved, enabling traders to make quicker and more informed decisions. While there are both advantages and disadvantages associated with their use, understanding these elements can help traders make better choices aligned with their investment goals.

By integrating Bitcoin trading bots into their investment strategies, traders can capitalize on opportunities around the clock while mitigating risks linked to emotional trading and human errors.