Most Affordable Bitcoin ETF Options, Comparing Costs and Features

In the realm of cryptocurrency investments, Bitcoin ETFs (Exchange-Traded Funds) have gained immense popularity for providing investors with an efficient way to gain exposure to Bitcoin\’s price movements without having to directly purchase the cryptocurrency. This article will explore the cheapest Bitcoin ETF options available, comparing their costs and features that appeal to budget-conscious investors.

In the realm of cryptocurrency investments, Bitcoin ETFs (Exchange-Traded Funds) have gained immense popularity for providing investors with an efficient way to gain exposure to Bitcoin’s price movements without having to directly purchase the cryptocurrency. This article will explore the cheapest Bitcoin ETF options available, comparing their costs and features that appeal to budget-conscious investors.

Understanding Bitcoin ETFs

Bitcoin ETFs are investment funds that track the price of Bitcoin. They trade on stock exchanges, similar to regular stocks, allowing investors to buy and sell shares. These funds provide a simpler method for investors who prefer not to manage private keys or worry about cryptocurrency wallets. Additionally, the growing popularity of Bitcoin has led to a variety of ETF options, each with different fee structures and investment strategies.

Key Features of Affordable Bitcoin ETFs

When searching for the most affordable Bitcoin ETFs, investors should consider several key features beyond just the expense ratio. These features significantly impact the total cost of ownership and overall investment return.

- Expense Ratio: The annual fee paid by ETF shareholders, expressed as a percentage of assets. It directly affects the net returns of the investment.

- Liquidity: High liquidity is essential for minimizing trading costs. ETFs with higher trading volumes tend to have tighter bid-ask spreads.

- Tracking Error: The deviation between the ETF’s performance and the actual price of Bitcoin. Lower tracking errors indicate better performance relative to the underlying asset.

Top Cheapest Bitcoin ETFs to Consider

Here, we will discuss some of the most affordable Bitcoin ETFs available in the market today:

- ProShares Bitcoin Strategy ETF (BITO): Known for its low expense ratio, BITO is one of the first Bitcoin ETFs to gain approval in the United States. It invests in Bitcoin futures, making it an attractive option for investors looking for affordability without sacrificing exposure.

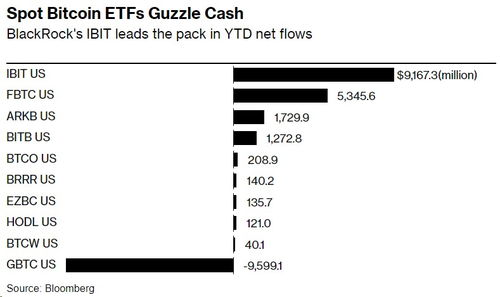

- Grayscale Bitcoin Trust (GBTC): While not a traditional ETF, GBTC trades like one. It provides investors with a cost-effective means to invest in Bitcoin but carries a higher management fee than some ETFs.

- Valkyrie Bitcoin Strategy ETF (BTF): Another strong contender in the ETF space, BTF focuses on Bitcoin futures and offers a competitive expense ratio, catering well to price-conscious investors.

It’s important for investors to compare not just the expense ratios but also the liquidity and tracking error associated with these funds. This analysis will help determine which ETF best fits their investment strategy.

In conclusion, choosing the right Bitcoin ETF can significantly impact investment returns, especially for those focused on minimizing costs. The options outlined in this article, such as BITO, GBTC, and BTF, provide a solid foundation for those looking to invest in Bitcoin while keeping expenses in check. As the cryptocurrency market continues to evolve, investors should stay informed about new ETF offerings and changes in fees, ensuring they make optimal investment decisions.