Bitcoin ETF SEC Authorization, Insights on Future Trends

The approval of Bitcoin ETFs (Exchange-Traded Funds) has become a pivotal issue in the cryptocurrency market. The U.S. Securities and Exchange Commission (SEC) has been scrutinizing these financial instruments, and their eventual approval could have significant implications for both investors and the broader market.

The approval of Bitcoin ETFs (Exchange-Traded Funds) has become a pivotal issue in the cryptocurrency market. The U.S. Securities and Exchange Commission (SEC) has been scrutinizing these financial instruments, and their eventual approval could have significant implications for both investors and the broader market.

The Significance of Bitcoin ETFs

Bitcoin ETFs are investment funds that track the price of Bitcoin, allowing investors to gain exposure to the cryptocurrency without needing to own it directly. This structure provides several advantages: it makes Bitcoin investment more accessible to mainstream investors, potentially drives institutional interest, and could help stabilize the price of Bitcoin through regulated markets.

The SEC and Bitcoin ETFs

The SEC’s role in overseeing the approval of Bitcoin ETFs mainly relates to investor protection and market integrity. Historically, the SEC has rejected multiple Bitcoin ETF applications due to concerns over market manipulation, lack of oversight, and inadequate liquidity. However, the evolving conversation surrounding cryptocurrencies and increased market maturity have brought a fresh perspective.

Recent Developments in SEC Applications

In 2

023, various firms have reapplied for Bitcoin ETF authorization, citing improved market conditions and regulatory frameworks. Notably, the landscape has changed with the emergence of Bitcoin Futures ETFs, which have received approval, showcasing the SEC’s potential openness to Bitcoin-based financial products. These developments have fueled speculation about the likely approval of a spot Bitcoin ETF, which would directly track the price of Bitcoin.

Potential Impacts of Approval

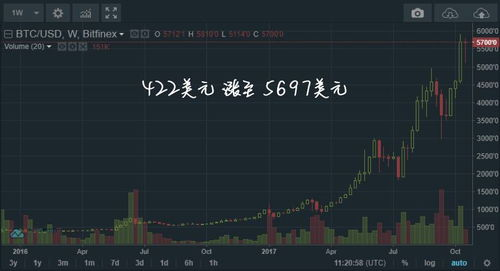

If the SEC approves a Bitcoin ETF, it could lead to an influx of investment in Bitcoin, transitioning it from a speculative asset to a more mainstream investment. This shift could improve liquidity and reduce volatility in the market. Furthermore, it would validate Bitcoin as a legitimate asset class in the eyes of institutional investors, potentially paving the way for other cryptocurrencies to follow suit.

Global Perspectives on Bitcoin ETFs

Internationally, several countries, including Canada and Brazil, have already granted approval for Bitcoin ETFs, demonstrating a wider acceptance of cryptocurrencies. Observing how these markets evolve will serve as a crucial reference point for the SEC’s future decisions. The success of these ETFs abroad could influence the SEC’s perspective and accelerate the approval process in the U.S.

In conclusion, the ongoing discussions around Bitcoin ETF SEC approval represent a significant turning point for the cryptocurrency market. The potential for an approved Bitcoin ETF not only signifies mainstream acceptance but also indicates a future where digital assets could play a more substantial role in traditional finance.