5 Bitcoin, The Ultimate Guide to Cryptocurrency Investment

Introduction

Introduction

Bitcoin has taken the financial world by storm, providing a decentralized alternative to traditional currency. In this article, we will explore what 5 Bitcoin means for both potential investors and cryptocurrency enthusiasts. Understanding Bitcoin is crucial in today’s digital economy, and we will delve into its significance, how it operates, and the opportunities it presents for those looking to invest in cryptocurrency.

Understanding Bitcoin

Bitcoin, the pioneering cryptocurrency, was created in 2009 by an individual or group using the pseudonym Satoshi Nakamoto. The currency enables peer-to-peer transactions without the need for intermediaries like banks or payment processors. This revolutionary system operates on a technology called blockchain, which ensures secure, transparent, and unchangeable transaction records.

The importance of Bitcoin has surged over the years as it has gained legitimacy and recognition among various financial institutions. With 5 Bitcoin, individuals can explore significant investment opportunities, as the value of Bitcoin has seen dramatic increases since its inception. For many, investing in Bitcoin represents a chance to diversify their portfolios and hedge against inflation.

Risks and Rewards of Investing in Bitcoin

Investing in Bitcoin can yield substantial returns, but it also comes with its own set of risks. Bitcoin’s price is notoriously volatile, and potential investors should be prepared for market fluctuations. At the same time, those who invest wisely have the potential to experience significant profits. Understanding this balance is crucial for anyone considering an investment of 5 Bitcoin.

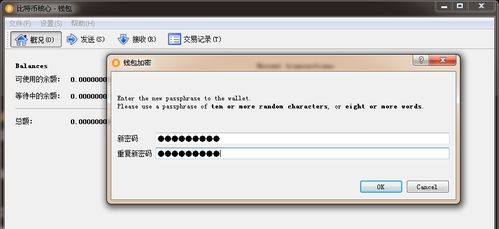

Moreover, security is a major concern. As Bitcoin transactions are irreversible, once a transaction is made, it cannot be undone. Therefore, securing your Bitcoin holdings with reliable wallets and employing robust security measures is essential. Additionally, it’s important to stay informed about regulatory changes affecting cryptocurrency, as they could impact investment dynamics.

Best Practices for Bitcoin Investment

To make the most out of an investment in Bitcoin, consider these best practices. First, conduct thorough research before purchasing or trading any cryptocurrency. Understanding market trends, historical data, and current events can provide insights into potential future movements in Bitcoin prices.

Next, diversify your cryptocurrency investments. While 5 Bitcoin can be a substantial investment, don’t put all your eggs in one basket. Explore other cryptocurrencies, or even traditional assets, to spread risk and enhance your investment strategy.

Lastly, consider long-term holding. Many successful investors adhere to the strategy of buying Bitcoin and holding it for an extended period, allowing their investments to appreciate in value over time. This approach aligns with the prevailing belief that Bitcoin will increase significantly as adoption widens.

Summary

Investing in 5 Bitcoin offers a glimpse into the promising world of cryptocurrency, marked by its potential for high returns and innovative technology. However, as with any investment, it is essential to understand the associated risks, adopt best practices, and remain vigilant about market dynamics. By strategically approaching Bitcoin investment, you can navigate the complexities of this digital currency and seize the potential rewards it offers in the ever-evolving financial landscape.