Bitcoin ETF in Cryptocurrency: Understanding Its Impact and Benefits

The world of cryptocurrencies has been rapidly evolving, with the introduction of various financial instruments. One of the most significant developments in recent years is the Bitcoin Exchange-Traded Fund (ETF). This article explores what a Bitcoin ETF is, its advantages, and its implications for both individual investors and the broader cryptocurrency market.

The world of cryptocurrencies has been rapidly evolving, with the introduction of various financial instruments. One of the most significant developments in recent years is the Bitcoin Exchange-Traded Fund (ETF). This article explores what a Bitcoin ETF is, its advantages, and its implications for both individual investors and the broader cryptocurrency market.

What is a Bitcoin ETF?

A Bitcoin ETF is a type of investment fund that aims to track the price of Bitcoin, allowing investors to buy shares in the fund rather than the cryptocurrency itself. This financial product enables people to gain exposure to Bitcoin’s price movement without needing to directly purchase and store the digital asset, thus simplifying the investment process.

The ETF holds Bitcoin or Bitcoin-related securities, and investors can trade shares of the ETF on traditional stock exchanges. This provides a regulated and familiar way for individuals and institutional investors to invest in Bitcoin without dealing with the complications of cryptocurrency exchanges and wallets.

Advantages of Bitcoin ETFs

There are several key advantages associated with investing in a Bitcoin ETF. Firstly, it provides accessibility to investors who may be hesitant to engage with cryptocurrencies directly. By offering a conventional investment vehicle, ETFs attract a broader range of investors who may not be comfortable with the complexities of crypto trading.

Additionally, Bitcoin ETFs can facilitate easier regulatory compliance. Since ETFs are governed by financial regulations, investors may feel more secure investing through this vehicle. The potential for increased transparency and oversight tends to inspire more confidence among traditional investors, leading to greater participation in the crypto market.

Another advantage is the tax efficiency of Bitcoin ETFs. Depending on the jurisdiction, these funds may offer favorable tax treatment compared to direct crypto investments. For instance, in some regions, capital gains taxes apply differently to ETFs compared to cryptocurrencies, making them a more appealing option for tax-conscious investors.

Implications for the Cryptocurrency Market

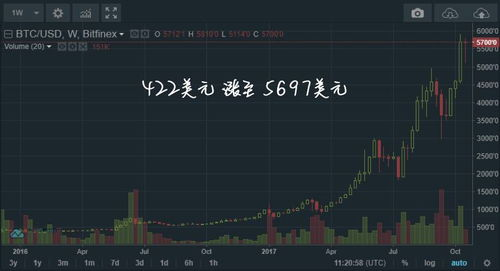

The introduction of Bitcoin ETFs has notable implications for the cryptocurrency market. First and foremost, it can lead to increased institutional investment, as large financial firms begin to allocate capital toward Bitcoin through ETFs. This influx of institutional money can drive up demand, thereby impacting Bitcoin’s price positively.

Moreover, the approval of Bitcoin ETFs often signals a level of maturity within the cryptocurrency market, indicating that regulatory bodies are becoming more comfortable with these digital assets. This growing acceptance can pave the way for more innovative financial products tied to cryptocurrencies.

However, there are also concerns regarding market volatility. The substantial demand generated by Bitcoin ETFs can lead to increased price fluctuations, which may pose risks for both investors and the broader financial system. As such, investors must remain cautious and informed when considering Bitcoin ETFs as an investment option.

In summary, Bitcoin ETFs present a compelling opportunity for investors interested in gaining exposure to Bitcoin without the complexities associated with owning the cryptocurrency directly. They offer various advantages, including accessibility, regulatory compliance, and potential tax efficiency. However, as the cryptocurrency market continues to evolve, investors should remain mindful of the associated risks. Overall, Bitcoin ETFs play a vital role in bridging the gap between traditional finance and the burgeoning world of digital assets.