Monochromatic Bitcoin Trust, Understanding Its Value and Importance

In the evolving landscape of cryptocurrencies, Bitcoin Trusts are becoming increasingly significant. Among these, the Grayscale Bitcoin Trust (GBTC) stands out due to its unique structure and investment strategy. This article delves into understanding the grayscale variant of Bitcoin Trusts, its implications, and its investment potential.

In the evolving landscape of cryptocurrencies, Bitcoin Trusts are becoming increasingly significant. Among these, the Grayscale Bitcoin Trust (GBTC) stands out due to its unique structure and investment strategy. This article delves into understanding the grayscale variant of Bitcoin Trusts, its implications, and its investment potential.

What is the Grayscale Bitcoin Trust?

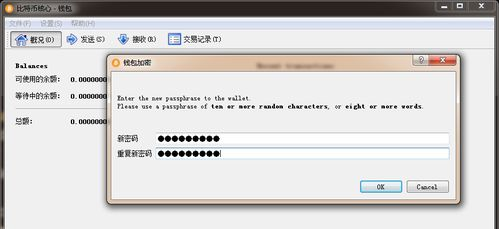

The Grayscale Bitcoin Trust is a publicly traded investment vehicle that allows individuals and institutional investors to gain exposure to Bitcoin without the need to directly buy or hold the cryptocurrency. This trust is designed to track the value of Bitcoin and is backed by actual Bitcoin held in custody. This means that each share represents a specific amount of Bitcoin, making it straightforward for investors to invest in Bitcoin without dealing with the complexities of wallets and private keys.

Benefits of Investing in Grayscale Bitcoin Trust

Investing in the grayscale Bitcoin Trust offers several advantages for potential investors. First, it provides a regulated investment platform, which is particularly appealing for institutional investors who may be wary of the unregulated aspects of cryptocurrency exchanges. Second, shares of GBTC are traded on public markets, allowing for easier entry and exit compared to traditional Bitcoin investments. Furthermore, the trust can also enhance tax efficiency for investors and simplify the investment process.

Market Performance and Trends

The market performance of the Grayscale Bitcoin Trust has seen significant fluctuations, akin to the Bitcoin itself. Initially, as Bitcoin prices surged, GBTC saw considerable premiums over the net asset value (NAV) of its Bitcoin holdings. However, with increased competition and changing market dynamics, these premiums have narrowed, leading to discounts in some trading scenarios. It’s crucial for investors to analyze these trends closely before making investment decisions.

Risks Involved

Despite the potential benefits, investing in the Grayscale Bitcoin Trust also comes with inherent risks. The volatility of Bitcoin prices can lead to substantial price swings in the trust’s shares. Additionally, investors need to consider the management fees associated with the trust, which may impact overall returns. It’s also vital to stay informed about regulatory changes that could affect the structure and operation of the trust.

In summary, the Grayscale Bitcoin Trust serves as a convenient investment vehicle for those looking to gain exposure to Bitcoin without the complexities of direct ownership. While it offers multiple advantages, potential investors should remain aware of the inherent risks and market volatility associated with cryptocurrency investments.