Cryptocurrency Trading: Buying and Selling Guide

In the fast-paced world of cryptocurrencies, effective trading strategies are essential for maximizing profits. This article will walk you through the fundamental aspects of buying and selling cryptocurrencies, ensuring that you can navigate this volatile market with ease.

In the fast-paced world of cryptocurrencies, effective trading strategies are essential for maximizing profits. This article will walk you through the fundamental aspects of buying and selling cryptocurrencies, ensuring that you can navigate this volatile market with ease.

Understanding Cryptocurrency Trading

Cryptocurrency trading involves the buying and selling of digital assets to capitalize on market fluctuations. The aim is to purchase cryptocurrencies at a low price and sell them at a higher price to realize profits. Several factors can influence the cryptocurrency market, including market trends, regulatory news, and technological advancements.

To successfully trade cryptocurrencies, it’s crucial to have a solid understanding of the basics, along with effective strategies that can guide your decisions. This begins with knowing how to select the right platforms for your trading activities.

Choosing a Trading Platform

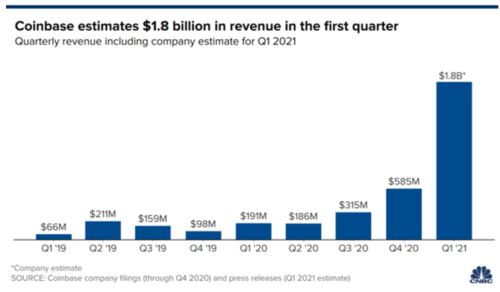

When it comes to crypto trading, the first step is selecting a reliable exchange platform. A good trading platform should be user-friendly, secure, and provide a variety of cryptocurrencies for trading. Popular instances of such platforms include Coinbase, Binance, and Kraken.

Additionally, ensure that the platform offers essential features such as advanced trading charts, market analysis tools, and a responsive customer support team to assist you with any issues that may arise during your trading journey.

Strategies for Buying Cryptocurrencies

When you decide to buy cryptocurrencies, it is important to have a well-thought-out strategy in place. One popular strategy is dollar-cost averaging (DCA

), which involves purchasing a fixed amount of cryptocurrency at regular intervals to reduce the impact of volatility.

Another strategy is to conduct thorough research and analysis. This includes staying informed on market trends, analyzing past performance, and understanding the potential growth of a cryptocurrency before making an investment.

Executing the Sale of Cryptocurrencies

After successfully purchasing cryptocurrencies, the next step is knowing when and how to sell them. A common approach is to set price targets based on your initial investment goals and market behavior. Utilize stop-loss orders to automatically sell your assets at a predetermined price to minimize losses.

Moreover, understanding market indicators can assist you in determining when to sell. Both technical analysis and market sentiment can provide valuable insights into the optimal time for a sale.

In summary, cryptocurrency trading encompasses a blend of strategic buying and selling. By selecting the right trading platform, employing effective buying strategies, and knowing when to execute sales, traders can significantly enhance their chances of success in the cryptocurrency market.