Trade View: Understanding Market Insights and Trends

In the fast-paced world of finance and investments, having a clear understanding of market insights and trends is crucial. \”Trade View\” provides a comprehensive overview of the essential elements traders need to make informed decisions. In this article, we will delve into the various aspects of trade analysis, the significant market indicators, and how to utilize trade views effectively to enhance trading strategies.

In the fast-paced world of finance and investments, having a clear understanding of market insights and trends is crucial. “Trade View” provides a comprehensive overview of the essential elements traders need to make informed decisions. In this article, we will delve into the various aspects of trade analysis, the significant market indicators, and how to utilize trade views effectively to enhance trading strategies.

Market Insights and Data Interpretation

To develop a successful trading strategy, one must first understand market insights thoroughly. Trade view tools analyze price movements, volume, and volatility to provide traders with a clearer picture of market conditions. By interpreting this data, traders can identify potential trading opportunities and risks.

For instance, utilizing candlestick patterns, support and resistance levels, and moving averages can significantly improve a trader’s ability to predict future price movements. Each of these elements plays a pivotal role in creating a reliable trade view that informs decision-making.

Significant Market Indicators

Market indicators are essential tools in trade view analysis. They help traders gauge market behavior and sentiment. Some of the most significant indicators include:

- Moving Averages: These indicators help smooth out price data by creating a constantly updated average price. Traders use moving averages to identify trends and potential reversals.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: These bands help traders understand volatility and price fluctuations by plotting standard deviations above and below a moving average.

By incorporating these indicators into trade view analysis, traders can make more informed decisions about when to enter or exit trades.

Utilizing Trade View Effectively

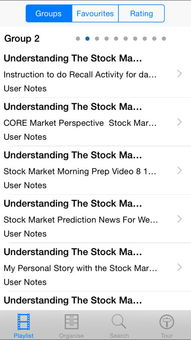

To maximize the benefits of trade view, traders should adopt a systematic approach. This includes continuous monitoring of market conditions, regular performance evaluations, and adapting strategies based on evolving market trends. Moreover, utilizing advanced trading platforms that provide detailed analytics and real-time data can further enhance a trader’s ability to interpret trade views accurately.

Additionally, traders should also focus on risk management techniques to protect their investments. Setting stop-loss orders, diversifying their portfolios, and maintaining a disciplined trading plan are key components of successful trading.

In summary, understanding trade view is integral to successful trading. By analyzing market insights, utilizing significant market indicators, and applying effective trading strategies, traders can improve their decision-making processes and enhance their overall trading performance. Embracing a routine of continuous learning and adaptation will further ensure that traders remain competitive in the ever-evolving financial markets.