BlackRock Spot Bitcoin Exchange-Traded Fund, Understanding Its Impact on Cryptocurrency Market

The emergence of BlackRock\’s Spot Bitcoin ETF signifies a substantial shift in the landscape of cryptocurrency investments. This article delves into various dimensions of BlackRock\’s initiative, from what a spot Bitcoin ETF entails, to its potential implications for the market.

The emergence of BlackRock’s Spot Bitcoin ETF signifies a substantial shift in the landscape of cryptocurrency investments. This article delves into various dimensions of BlackRock’s initiative, from what a spot Bitcoin ETF entails, to its potential implications for the market.

What is a Spot Bitcoin ETF?

A Spot Bitcoin ETF, or Exchange-Traded Fund, is designed to track the price of Bitcoin directly rather than through futures contracts. This means that investors in a spot Bitcoin ETF own shares which are directly tied to the actual Bitcoin price. BlackRock, a global investment firm, is planning to launch this type of product, catering to a growing demand for cryptocurrency investment options. The focus on spot rather than futures allows for a more straightforward investment strategy, appealing to both institutional and retail investors.

BlackRock’s Position in the Financial World

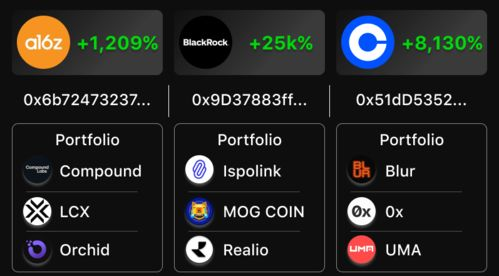

BlackRock is one of the largest and most influential asset management firms globally. Its entry into the cryptocurrency market carries significant weight and signals an increasing acceptance and institutional interest in Bitcoin as an asset class. The firm is regarded as a leader in investment products, and its foray into the crypto space is expected to bring a robust framework and credibility to Bitcoin investing.

The Potential Market Impact

The introduction of a BlackRock Spot Bitcoin ETF could potentially lead to increased liquidity in the Bitcoin market. It offers a regulated investment vehicle for institutional investors, which could lead to significant capital inflow into Bitcoin. As BlackRock’s reputation and reach expand, the ETF could encourage more traditional investors to consider Bitcoin as a viable part of their portfolios, propelling Bitcoin’s adoption further into the mainstream.

Regulatory Considerations

The establishment of a spot Bitcoin ETF by BlackRock does not come without regulatory hurdles. The firm must navigate the complex landscape of securities laws and obtain approval from regulatory bodies like the SEC. This process will involve demonstrating the ETF’s compliance with market regulations, ensuring investor protection, and addressing concerns over market manipulation in the cryptocurrency sector.

Conclusion

BlackRock’s Spot Bitcoin ETF represents a significant step towards legitimizing Bitcoin as a mainstream financial product. Through this offering, the firm may enhance liquidity, attract institutional investment, and promote wider acceptance of cryptocurrency. The regulatory path ahead is crucial, and the movements made by both BlackRock and regulators will be closely watched by investors worldwide.

In conclusion, the development of the BlackRock Spot Bitcoin ETF marks a pivotal moment for the cryptocurrency market. Its potential to reshape investment strategies and attract new investors underscores the evolving nature of Bitcoin as an asset class.