Bitcoin Hash Rate: Understanding Its Importance, Trends, and Impacts

Bitcoin, the first and most well-known cryptocurrency, relies heavily on a measure known as hash rate. This article delves into the concept of hash rate, its significance in the Bitcoin network, current trends, and its broader implications in the world of cryptocurrencies.

Bitcoin, the first and most well-known cryptocurrency, relies heavily on a measure known as hash rate. This article delves into the concept of hash rate, its significance in the Bitcoin network, current trends, and its broader implications in the world of cryptocurrencies.

What is Bitcoin Hash Rate?

Hash rate refers to the computational power used by miners to process transactions and secure the Bitcoin network. It is typically measured in hashes per second (H/s

), with larger units such as kilohashes (KH/s

), megahashes (MH/s

), gigahashes (GH/s

), and terahashes (TH/s) used for practicality as the power of mining hardware increases. A higher hash rate indicates a more secure network, as it becomes more difficult for malicious actors to take control or manipulate the network.

Bitcoin mining involves solving complex mathematical equations, and each solution is a hash. Consequently, miners compete to solve these problems and verify transactions, for which they are rewarded in Bitcoin.

The Importance of Hash Rate in Bitcoin

Hash rate is crucial for the security and stability of the Bitcoin network. It directly affects the time it takes to mine new blocks – lower hash rates can lead to longer block times and increased transaction delays. Additionally, a strong hash rate serves as a deterrent against potential attacks, as an adversary would need to control a significant portion of the total hashing power to disrupt the network.

Moreover, the hash rate plays a role in miner profitability. As more miners join the network, the difficulty of solving equations increases, requiring even greater computational power to remain competitive and earn rewards.

Current Trends in Bitcoin Hash Rate

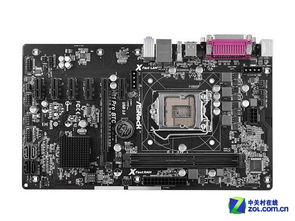

In recent years, the Bitcoin hash rate has shown substantial growth, reflecting increased interest and investment in crypto mining technology. As of the latest data, the hash rate has reached unprecedented heights, often surpassing 200 exahashes per second (EH/s). This upward trend can be attributed to advancements in mining hardware, such as ASIC (Application-Specific Integrated Circuit) miners, which significantly enhance mining efficiency.

Another factor contributing to the rising hash rate is the continual increase in Bitcoin’s value, which incentivizes more miners to participate in the network. However, potential regulations and energy concerns may also affect future hash rate growth. Mining operations, particularly in regions with low energy costs, may face scrutiny regarding their environmental impact, prompting some miners to adapt or relocate their operations.

The Broader Implications of Bitcoin Hash Rate

The hash rate not only reflects the health of the Bitcoin network but also serves as an indicator of market confidence in the cryptocurrency sector. A high hash rate generally correlates with a bullish market sentiment, positioning Bitcoin as a resilient investment asset. It also aligns with the overarching narrative of decentralized finance (DeFi

), where robust security and fair transaction processing are paramount.

However, it is essential to monitor potential fluctuations in hash rate, as sudden drops can signal negative trends, such as increased mining difficulty or reduced miner profitability, which could potentially impact the entire network’s health.

In conclusion, the Bitcoin hash rate is a pivotal component in understanding the dynamics of the cryptocurrency. Its implications stretch beyond simple mining operations, influencing market behavior, investment confidence, and the overall security of the Bitcoin network. Staying informed about hash rate trends can provide valuable insights for miners, investors, and enthusiasts alike.