Digital Currency Exchange Marketplace, Essential Tools for Cryptocurrency Trading

In today\’s fast-paced financial landscape, cryptocurrency trading has emerged as a pivotal avenue for investment and revenue generation. Choosing the right cryptocurrency market trading platform can significantly influence your trading experience and outcomes. This article aims to delve into the vital aspects of selecting a digital currency exchange marketplace, providing insights on functionality, security, and user experience.

In today’s fast-paced financial landscape, cryptocurrency trading has emerged as a pivotal avenue for investment and revenue generation. Choosing the right cryptocurrency market trading platform can significantly influence your trading experience and outcomes. This article aims to delve into the vital aspects of selecting a digital currency exchange marketplace, providing insights on functionality, security, and user experience.

Understanding Cryptocurrency Trading Platforms

Cryptocurrency trading platforms serve as intermediaries where users can buy, sell, or trade cryptocurrencies. These platforms can cater to a variety of user needs, from novice traders to seasoned investors looking for specific features. A marketplace that thrives on liquidity and offers a broad range of cryptocurrencies is usually essential for any trader.

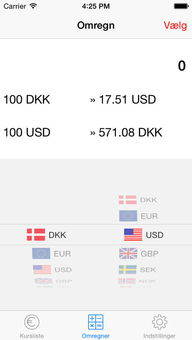

One crucial aspect of these platforms is their user interface. A well-designed marketplace should be intuitive and user-friendly, enabling traders to navigate through various sections seamlessly. This enhances the overall trading experience, making it easier for individuals to make informed decisions quickly.

Additionally, the trade execution speed on these platforms is vital. A rapid response time allows traders to take advantage of fleeting market opportunities, which is crucial in the volatile cryptocurrency market.

Key Features to Look for in a Trading Platform

When selecting a cryptocurrency market trading platform, several critical features should be evaluated. Each of these elements plays a significant role in ensuring that users have a hassle-free trading experience.

The security of your digital assets is paramount. A reputable platform should implement advanced security measures, including two-factor authentication, encryption protocols, and regular security audits. These factors collectively safeguard user accounts and data against breaches.

A diverse selection of cryptocurrencies enables traders to explore numerous trading options. Platforms offering many altcoins alongside dominant currencies like Bitcoin and Ethereum can be particularly appealing to investors seeking growth opportunities.

Understanding the fee structure is crucial, as it directly impacts the profitability of your trades. Platforms with transparent and competitive fee structures can help traders maximize their profits over time.

Accessible customer support and educational resources create a supportive trading environment. Look for platforms that provide live chat support and a comprehensive knowledge base to assist users in their trading endeavors.

In conclusion, choosing the right cryptocurrency market trading platform involves an assessment of multiple factors, including security, usability, variety of cryptocurrencies, fees, and support offerings. By carefully evaluating these elements, traders can select a digital currency exchange marketplace that aligns with their trading goals and preferences, ultimately leading to a more successful trading experience.