Bitcoin to Dollar Conversion, Understanding the Value

In recent years, the cryptocurrency market has surged in popularity, with Bitcoin leading the charge as the most well-known digital asset. Understanding the conversion between Bitcoin (BTC) and United States Dollars (USD) is crucial for investors and enthusiasts alike. This article will delve into how to convert Bitcoin to USD and provide insights into the factors influencing its value.

In recent years, the cryptocurrency market has surged in popularity, with Bitcoin leading the charge as the most well-known digital asset. Understanding the conversion between Bitcoin (BTC) and United States Dollars (USD) is crucial for investors and enthusiasts alike. This article will delve into how to convert Bitcoin to USD and provide insights into the factors influencing its value.

What is Bitcoin?

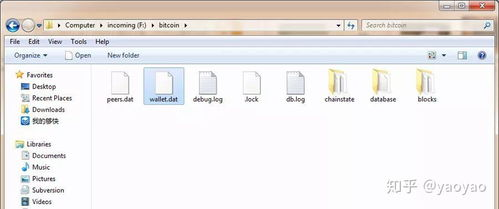

Bitcoin is a decentralized digital currency created in 2009 by an anonymous entity known as Satoshi Nakamoto. It operates on a peer-to-peer network, allowing users to send and receive payments without the need for a central authority. The value of Bitcoin can fluctuate dramatically, which makes it an attractive, albeit volatile, investment option.

How to Convert Bitcoin to USD?

To convert 0.00001352 BTC to USD, one can use a simple formula. Multiply the amount of Bitcoin you have by the current exchange rate for Bitcoin in USD. For example, if the current exchange rate is

$30,000 for 1 BTC, the calculation would be:

0.00001352 BTC ×

$30,000 = $0.4056

This means that 0.00001352 BTC is equivalent to approximately $0.4056 at this exchange rate.

Factors Influencing BTC to USD Conversion Rates

Several elements can impact the value of Bitcoin when converting to USD. These include market demand, regulatory news, technological advancements, and overall market conditions. It is essential to stay informed about these factors, as they can affect the price of Bitcoin significantly.

Practical Implications of BTC to USD Conversions

Understanding how to convert BTC to USD can be beneficial not only for trading but also for planning investments. Investors should consider keeping an eye on market trends and historical data, allowing them to make informed decisions about their digital assets.

In conclusion, converting Bitcoin to USD is a straightforward process that involves knowing the current exchange rate. By understanding the factors that influence these conversion rates, investors can better navigate the cryptocurrency market and make educated choices. Being proactive in monitoring market conditions will allow one to optimize their BTC investments effectively.