Real-time BTC/USD Trading Information, Insights, and Trends

In the world of cryptocurrency, keeping an eye on live BTC/USD prices is crucial for traders and investors alike. This article delves into the importance of real-time data, the factors influencing Bitcoin, and tips for making informed trading decisions.

In the world of cryptocurrency, keeping an eye on live BTC/USD prices is crucial for traders and investors alike. This article delves into the importance of real-time data, the factors influencing Bitcoin, and tips for making informed trading decisions.

Understanding Live BTC/USD Prices

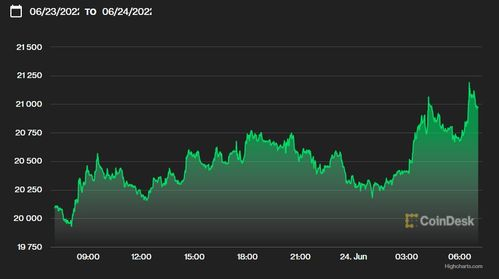

The BTC/USD trading pair represents the value of one Bitcoin expressed in US dollars. Real-time prices are essential for anyone looking to engage in cryptocurrency trading, as they provide up-to-the-minute information on market fluctuations. By monitoring these prices, traders can make well-informed decisions and potentially maximize their profits.

Live BTC/USD rates are influenced by various factors, including market demand, regulatory changes, technological advancements, and broader economic trends. Traders need to understand how these elements can affect price movements to navigate the cryptocurrency landscape effectively.

Factors Influencing BTC/USD Prices

Several key factors play a significant role in determining the price of Bitcoin against the US dollar. Understanding these elements can provide traders with a strategic advantage.

The overall sentiment in the market, driven by news headlines, social media chatter, and investor behavior, can heavily influence the BTC/USD price. Positive news can lead to price surges, while negative events often cause declines.

The basic economic principle of supply and demand is at work in the cryptocurrency market. As more investors buy Bitcoin, the price tends to rise. Conversely, if selling exceeds buying, the value will decrease.

New regulations or government interventions can impact Bitcoin’s price significantly. For instance, favorable regulations can boost investor confidence, whereas restrictive measures may result in market downturns.

Strategies for Trading BTC/USD

For traders looking to profit from BTC/USD fluctuations, several strategies can be employed:

Utilizing charts, indicators, and historical price data helps traders make predictions about future movements. Technical analysis is essential for identifying entry and exit points in trades.

Implementing risk management techniques, such as setting stop-loss orders, helps protect traders from significant losses. It’s crucial to define a risk-reward ratio before entering any trade.

Stay informed on the latest news and trends affecting Bitcoin. Following reputable sources and market analysts on social media can provide valuable insights and updates.

In summary, monitoring live BTC/USD prices is essential for successful trading in the cryptocurrency market. By understanding the factors influencing Bitcoin’s value and implementing effective trading strategies, investors can better navigate the complexities of the crypto landscape. Staying informed and utilizing technical analysis will enhance one’s ability to make timely and profitable trading decisions.