Currency Innovations, A Deep Dive into Digital Exchange Trends

In recent years, the world of finance has witnessed a significant transformation with the rise of various digital currencies and exchange platforms. This article explores the innovative trends in currency exchange, focusing on how digital currencies, such as cryptocurrencies, are reshaping the landscape of financial transactions.

In recent years, the world of finance has witnessed a significant transformation with the rise of various digital currencies and exchange platforms. This article explores the innovative trends in currency exchange, focusing on how digital currencies, such as cryptocurrencies, are reshaping the landscape of financial transactions.

The Emergence of Digital Currency

The emergence of digital currencies marks a revolutionary change in how we perceive and engage in monetary transactions. Traditional currencies are now complemented by these digital alternatives, which offer unique qualities, including decentralization, increased security, and accessibility. Cryptocurrencies like Bitcoin and Ethereum have paved the way for this financial evolution, providing individuals and businesses with alternative means to conduct transactions without the need for intermediaries.

These currencies can be exchanged globally, transcending geographical barriers, which makes them attractive for international trade and remittances. The rise of blockchain technology has further enriched the transparency and security of these transactions, addressing one of the major concerns in traditional banking systems.

Trends in Digital Exchange Platforms

As the digital currency landscape develops, several key trends have emerged in the exchange platforms where these currencies are traded. One prominent trend is the increasing integration of decentralized finance (DeFi) applications. DeFi platforms allow users to engage in financial services such as lending, borrowing, and earning interest without traditional banking intermediaries. This has democratized access to financial services, enabling individuals from all backgrounds to participate in the global economy.

Additionally, the concept of non-fungible tokens (NFTs) has gained traction, revolutionizing the way digital assets are bought, sold, and owned. NFTs have introduced scarcity and ownership to the digital realm, allowing creators to monetize their work in novel ways and providing collectors with unique digital assets.

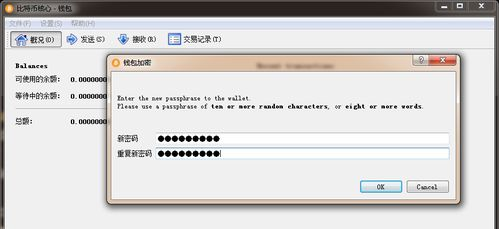

Moreover, the user experience on digital exchange platforms is continuously improving, with many platforms prioritizing intuitive interfaces and enhanced security measures. As these platforms adapt to user needs, we observe a growing trend toward offering educational resources, thereby empowering users to make informed decisions in their trading activities.

Challenges Ahead for Digital Currency

While the potential of digital currencies and exchanges is vast, they are not without challenges. Regulatory scrutiny remains a significant concern, as governments and financial institutions grapple with how to integrate these new assets into existing frameworks. Striking a balance between innovation and consumer protection is crucial as the landscape continues to evolve.

Additionally, the volatility associated with cryptocurrencies poses risks for users and investors, making it imperative for stakeholders to remain vigilant and informed. As the market matures, stability may improve, but the journey to mainstream acceptance will require ongoing adaptation and resilience.

In conclusion, the digital currency revolution is a dynamic wave reshaping the financial landscape through innovative exchange platforms and practices. With advancements in technology and a growing acceptance of digital assets, the future of currency exchange appears promising, albeit with challenges that must be navigated strategically.