Exchange Bitcoin: Strategies for Successful Trading

In the world of cryptocurrency, Bitcoin stands out as the most widely recognized and valuable digital currency. For anyone looking to venture into the realm of Bitcoin trading, understanding the various strategies, techniques, and tools available is essential. This article delves into effective strategies for exchanging Bitcoin successfully.

In the world of cryptocurrency, Bitcoin stands out as the most widely recognized and valuable digital currency. For anyone looking to venture into the realm of Bitcoin trading, understanding the various strategies, techniques, and tools available is essential. This article delves into effective strategies for exchanging Bitcoin successfully.

Understanding Bitcoin Trading

Bitcoin trading involves buying and selling Bitcoin with the aim of making a profit. It can be done via different platforms known as cryptocurrency exchanges, where traders can swap Bitcoin for other currencies or tokens. Understanding the market dynamics and the factors influencing Bitcoin prices is crucial for anyone looking to trade effectively. Major influencers include market news, technological developments, and overall market sentiment.

Additionally, comprehending different trading methods such as day trading, swing trading, and long-term holding can help traders align with their financial goals and risk tolerance. Each method carries its own level of investment and market interaction.

Key Strategies for Bitcoin Trading

There are several strategies that traders can consider when engaging in Bitcoin trading:

Utilizing charts and historical data is a common strategy in trading. Traders analyze price movements and patterns to predict future fluctuations. Tools such as moving averages, relative strength index (RSI

), and Bollinger Bands can provide insights into when to buy or sell Bitcoin.

This strategy involves evaluating the underlying factors that can affect Bitcoin’s value, such as regulatory news, technological advancements, and macroeconomic trends. Staying updated with news events and understanding their implications can significantly impact trading decisions.

Choosing the Right Exchange

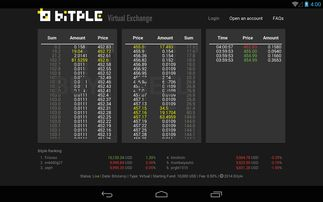

When trading Bitcoin, selecting the right exchange platform is paramount. Factors to consider include security features, transaction fees, available trading pairs, and user reviews. Well-known exchanges such as Coinbase, Binance, and Kraken offer varied services and features that cater to different types of traders.

Moreover, ensuring that the chosen exchange has a user-friendly interface can enhance the trading experience, especially for beginners.

Risk Management in Bitcoin Trading

Risk management is a key aspect of successful trading. Setting stop-loss orders and maintaining a diversified portfolio can help mitigate risks associated with Bitcoin’s high volatility. Traders should always invest an amount they can afford to lose and avoid making impulsive decisions based on market hype.

Additionally, keeping educated on market trends and continuously assessing one’s trading strategy can lead to more informed and calculated risk-taking.

In conclusion, successfully trading Bitcoin requires a sound understanding of market intricacies, effective strategies, and robust risk management. By employing technical and fundamental analysis, choosing the right exchange, and managing risks, traders can improve their chances of success in the volatile Bitcoin market. Embracing a disciplined approach while staying informed about the rapidly evolving cryptocurrency landscape is crucial for achieving the desired trading outcomes.