Cryptocurrency Surge 2024, What to Expect and How to Prepare

As we approach the year 2

024, the cryptocurrency market is on the verge of significant changes and potential growth. Investors are keenly interested in the possibility of a crypto rally, which could translate to substantial gains for those who prepare properly. This article explores the factors that could contribute to a rally in the cryptocurrency market in 2

024, and the strategies investors can employ to be ready for such developments.

As we approach the year 2

024, the cryptocurrency market is on the verge of significant changes and potential growth. Investors are keenly interested in the possibility of a crypto rally, which could translate to substantial gains for those who prepare properly. This article explores the factors that could contribute to a rally in the cryptocurrency market in 2

024, and the strategies investors can employ to be ready for such developments.

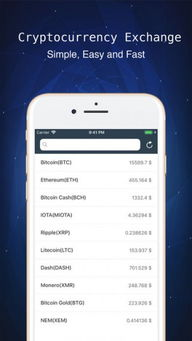

The Current Landscape of Cryptocurrency

The year 2023 has seen a mix of volatility and growth for cryptocurrencies. As mainstream acceptance increases and regulatory frameworks begin to solidify, many investors are curious about what 2024 holds. Current trends show significant interest in decentralized finance (DeFi

), non-fungible tokens (NFTs

), and blockchain technology. Analyzing these elements will help us understand the upcoming potential crypto rally.

2024 is anticipated to witness innovations and adaptations in various cryptocurrencies, such as Bitcoin, Ethereum, and new emerging tokens. Potentially influencing factors include technological advancements, large institutional investments, and sociopolitical elements that could create a favorable market atmosphere for resurgent crypto valuations.

Factors Fueling the Crypto Rally

Several key factors could contribute to a cryptocurrency rally in 2024:

As governments around the world aim to regulate the crypto space, clearer guidelines may encourage more investors to enter the market. Regulations that protect consumers while allowing for innovation are essential for long-term stability and growth. The clarity that comes with legal frameworks provides a safety net for hesitant investors.

Institutional interest in cryptocurrencies continues to grow. Major financial institutions are increasingly integrating cryptocurrencies into their portfolios, which boosts legitimacy in the market. With larger funds allocating resources to digital assets, this influx may trigger a rally in 2024 as confidence grows in the asset class.

Sentiments play a critical role in market dynamics. Positive media coverage can drive interest and investment in cryptocurrencies, leading to increased prices. Social media channels and influencers will undoubtedly impact perceptions of cryptocurrencies in 2024. Keeping abreast of market sentiment could help investors position themselves ahead of a potential rally.

Investment Strategies for 2024

If a cryptocurrency rally does occur in 2

024, investors must be prepared with effective strategies. Consider the following approaches:

Investing across a range of cryptocurrencies can mitigate risk. While some assets may experience significant gains, others may fluctuate. Diversification allows investors to spread risk and potentially capitalize on various fronts during a rally.

Keeping updated on the latest trends, news, and technological advancements is crucial. Resources such as crypto news websites, financial reports, and expert analyses can provide valuable insights. Regularly updating your knowledge about the market enhances decision-making capabilities.

Investors should consider adopting a long-term perspective rather than chasing short-term gains. Markets can be volatile, but a focus on the long-term potential of cryptocurrencies may yield better results. Understanding the fundamentals of cryptocurrencies and their underlying technology instills confidence in holding investments despite market fluctuations.

In conclusion, the year 2024 holds the potential for a significant cryptocurrency rally, fueled by regulatory clarity, institutional investment, and dynamic market sentiment. Investors should equip themselves with diversified portfolios, remain informed about industry developments, and adopt a long-term investment approach to maximize their prospects in this evolving landscape. As the cryptocurrency market continues to mature, those who prepare adequately may witness substantial opportunities ahead.