Bitcoin ETF SEC Endorsement, Potential Market Implications

Bitcoin has transformed the landscape of finance, but its acceptance by mainstream financial institutions and regulators remains a pivotal factor. As Bitcoin Exchange-Traded Funds (ETFs) seek approval from the U.S. Securities and Exchange Commission (SEC

), the implications could resonate throughout the market. This article delves into the significance of SEC endorsement for Bitcoin ETFs and the potential benefits it could offer to investors.

Bitcoin has transformed the landscape of finance, but its acceptance by mainstream financial institutions and regulators remains a pivotal factor. As Bitcoin Exchange-Traded Funds (ETFs) seek approval from the U.S. Securities and Exchange Commission (SEC

), the implications could resonate throughout the market. This article delves into the significance of SEC endorsement for Bitcoin ETFs and the potential benefits it could offer to investors.

Understanding Bitcoin and Its Journey

Bitcoin emerged as the first cryptocurrency in 2

009, disrupting traditional financial paradigms. Its decentralized nature and finite supply have attracted attention from global investors. However, institutional participation has faced hurdles due to regulatory uncertainties, particularly regarding the approval of Bitcoin ETFs. The SEC has been cautious, necessitating clarity around the market’s mechanics and the security of such investment vehicles.

The Role of the SEC in Cryptocurrency Regulation

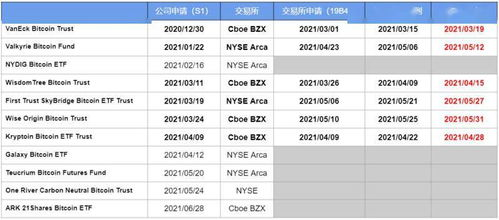

The U.S. SEC plays a critical role in the regulation of securities, including ETFs. Their primary concern lies in protecting investors from potential fraud and market manipulation. As Bitcoin’s popularity grows, the SEC’s stance on Bitcoin ETFs has become increasingly important. The commission has historically rejected multiple proposals, emphasizing the need for surveillance mechanisms and strong operational frameworks within the cryptocurrency space.

Potential Benefits of SEC Approval

SEC approval of Bitcoin ETFs would mark a significant milestone for the cryptocurrency market. Firstly, it would provide a safer and easier way for traditional investors to gain exposure to Bitcoin without direct purchases. This is particularly appealing for those hesitant about cryptocurrency wallets and exchanges. Additionally, the influx of institutional funds could enhance Bitcoin’s legitimacy and drive its adoption further.

Secondly, SEC approval could lead to increased liquidity in the market, which is often hindered by lack of investor confidence. A regulated environment would likely encourage higher participation, thus boosting prices and stabilizing volatility. Moreover, this regulatory endowment could inspire more firms to explore the development of innovative financial products surrounding cryptocurrency.

Market Challenges Ahead

However, the path to approval is not devoid of challenges. Factors such as market volatility, manipulation concerns, and technological hurdles persist. The SEC may impose strict requirements on fund management and reporting standards, leading to potential delays in approvals. Stakeholders will need to address these issues convincingly to gain the SEC’s trust.

In conclusion, the SEC’s endorsement of Bitcoin ETFs could usher in a new era for the cryptocurrency market, providing a gateway for institutional investment and broader market acceptance. While hurdles remain, the potential rewards could reshape how investors perceive and interact with Bitcoin. As the discussion continues, the outcome could have far-reaching implications, fundamentally altering the investment landscape for digital currencies.