Vanguard Bitcoin, Cryptocurrency Investment, and Diversification Strategies

In recent years, Bitcoin and other cryptocurrencies have gained significant attention as viable investment options. This article discusses Vanguard\’s approach to Bitcoin investments, how cryptocurrency can play a role in portfolio diversification, and key strategies for investors looking to navigate this volatile market.

In recent years, Bitcoin and other cryptocurrencies have gained significant attention as viable investment options. This article discusses Vanguard’s approach to Bitcoin investments, how cryptocurrency can play a role in portfolio diversification, and key strategies for investors looking to navigate this volatile market.

Understanding Vanguard’s Position on Bitcoin

Vanguard, a renowned investment management company, has traditionally focused on mutual funds and ETFs. While they have remained cautious about direct Bitcoin investments, that doesn’t mean they dismiss the cryptocurrency’s potential. Understanding Vanguard’s stance can help investors gauge the company’s outlook on cryptocurrencies and how they can integrate these digital assets into their overall investment strategy.

One of Vanguard’s primary principles is to prioritize long-term investing strategies. In this context, Bitcoin is often viewed with skepticism due to its price volatility, historical bubbles, and regulatory uncertainties. However, Vanguard acknowledges the growing interest in cryptocurrencies among investors, suggesting a careful examination of their potential role in modern portfolios.

Cryptocurrency in Portfolio Diversification

Diversification is a critical principle in investing and can significantly reduce risk. Traditionally, portfolios have included a mix of equities, bonds, and real estate. With the rise of digital currencies, many investors are exploring how Bitcoin and other cryptocurrencies can enhance their diversification strategies.

Bitcoin, being a relatively new asset class, presents unique opportunities and risks. Its low correlation with traditional asset classes can make it an attractive option for diversifying investment portfolios. By incorporating Bitcoin into an investment strategy, investors may achieve improved risk-adjusted returns over time due to the asset’s distinct performance characteristics.

However, investors should be cautious and ensure that they do not overexpose themselves to Bitcoin’s price fluctuations. It is advisable to treat cryptocurrency investments as a small percentage of a diversified portfolio, typically no more than 5-10%, depending on individual risk tolerance and investment goals.

Key Strategies for Investing in Bitcoin

As Bitcoin continues to evolve, investors should adopt strategic approaches when considering this asset. Here are some key strategies for navigating the Bitcoin market:

- Research and Education: Stay informed about the latest trends in the cryptocurrency market, including potential regulatory changes and technological advancements.

- Long-Term Perspective: Consider adopting a long-term investment strategy, as Bitcoin’s price can be highly volatile in the short term.

- Dollar-Cost Averaging: To mitigate the impact of price fluctuations, investors can utilize dollar-cost averaging, which involves investing a fixed amount regularly, regardless of Bitcoin’s price.

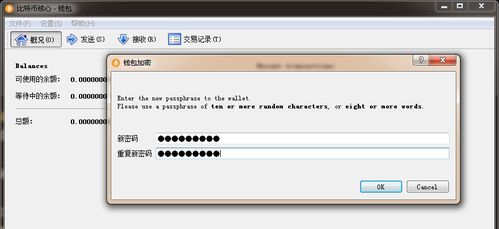

- Secure Storage: Ensure that your Bitcoin investments are stored securely, whether through cold wallets or reputable exchanges.

In summary, Bitcoin represents an emerging asset class that offers unique opportunities for investors. While Vanguard approaches this volatile market with caution, the potential for portfolio diversification through cryptocurrencies cannot be ignored. By employing thoughtful strategies and maintaining a long-term outlook, investors can explore how Bitcoin may fit into their overall financial plans.