Bitcoin Mini Trust Shares: A Convenient Investment Opportunity

Investing in Bitcoin has become increasingly popular among individuals looking to capitalize on the growth of cryptocurrencies. Among the various options available, Bitcoin Mini Trust Shares stand out as a convenient and accessible way for investors to participate in the cryptocurrency market without directly holding Bitcoin.

Investing in Bitcoin has become increasingly popular among individuals looking to capitalize on the growth of cryptocurrencies. Among the various options available, Bitcoin Mini Trust Shares stand out as a convenient and accessible way for investors to participate in the cryptocurrency market without directly holding Bitcoin.

Understanding Bitcoin Mini Trust Shares

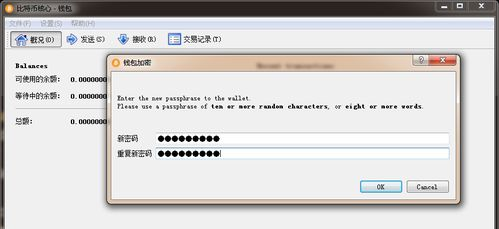

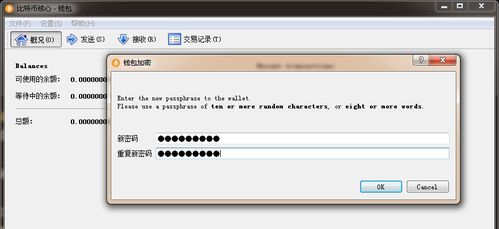

Bitcoin Mini Trust Shares serve as investment vehicles that allow investors to gain exposure to the performance of Bitcoin without the challenges of managing wallets and private keys. These shares are typically managed by investment companies that hold Bitcoin on behalf of the shareholders. This offers a streamlined way for investors to engage with Bitcoin while mitigating some of the risks associated with direct ownership.

The trust format provides a level of security as investors can buy and sell shares in a regulated environment. This is particularly beneficial for those who may feel overwhelmed by the complexities of trading cryptocurrencies directly. Moreover, these shares can often be bought and sold on traditional stock exchanges, making them accessible to a broader audience.

Benefits of Investing in Bitcoin Mini Trust Shares

One of the main advantages of Bitcoin Mini Trust Shares is the convenience they offer. Investors do not need to worry about the technicalities of Bitcoin transactions, such as gas fees and the intricacies of wallet management. Instead, they can focus on the potential gains associated with the price movements of Bitcoin.

Additionally, the trust structure can provide a layer of transparency and regulatory oversight, which can enhance investor confidence. The performance of the trust is typically linked directly to the performance of Bitcoin, providing a straightforward way to track investments without the noise associated with cryptocurrency exchanges.

Another benefit includes the ability to diversify. Investors can include Bitcoin Mini Trust Shares in their broader investment portfolios alongside stocks and bonds, which can help enhance diversification and potentially reduce overall portfolio volatility.

Considerations and Risks

While Bitcoin Mini Trust Shares offer many advantages, there are also considerations that investors should be aware of. Like any investment linked to cryptocurrencies, there can be significant volatility. Therefore, understanding the market dynamics and the underlying asset is essential.

Moreover, management fees associated with the trust can affect overall returns. It is essential for investors to review all fees and expenses prior to investing. As with any investment, it is advisable to conduct thorough research or consult with a financial advisor to ensure that Bitcoin Mini Trust Shares align with individual financial goals.

In conclusion, Bitcoin Mini Trust Shares present a unique opportunity for investors seeking exposure to Bitcoin without the complexities of direct ownership. By offering convenience, regulatory oversight, and ease of trading, these shares allow for a straightforward investment approach. However, it is crucial to be aware of the risks and perform due diligence to make informed investment decisions.