BTC vs WBTC, Understanding Their Key Differences

In the world of cryptocurrencies, Bitcoin (BTC) and Wrapped Bitcoin (WBTC) are two essential assets that often come up in discussions. Although they share similar names and are both based on the Bitcoin ecosystem, they serve distinct purposes within the blockchain universe. This article aims to break down their key differences, uses, and how they fit into the broader cryptocurrency landscape.

In the world of cryptocurrencies, Bitcoin (BTC) and Wrapped Bitcoin (WBTC) are two essential assets that often come up in discussions. Although they share similar names and are both based on the Bitcoin ecosystem, they serve distinct purposes within the blockchain universe. This article aims to break down their key differences, uses, and how they fit into the broader cryptocurrency landscape.

What is BTC?

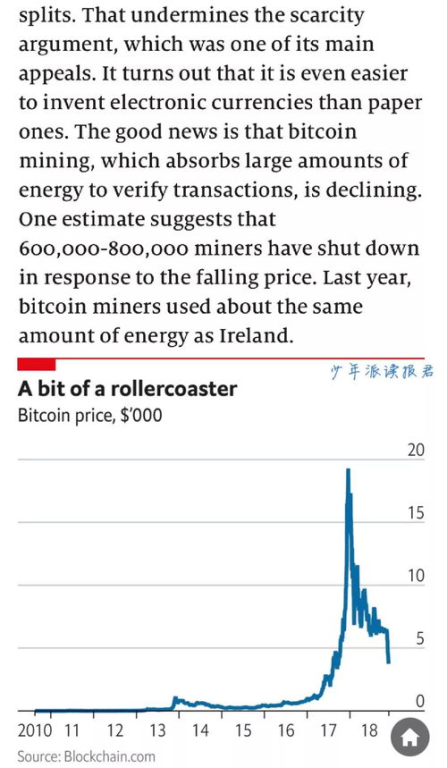

Bitcoin, often referred to as BTC, is the original cryptocurrency that operates on a decentralized network without the need for intermediaries. Launched in 2

009, Bitcoin has established itself as a store of value and a medium of exchange due to its limited supply of 21 million coins. BTC is primarily used for peer-to-peer transactions and has gained recognition as digital gold, attracting investors aiming to hedge against inflation and economic instability.

What is WBTC?

Wrapped Bitcoin, or WBTC, is an ERC-20 token that represents Bitcoin on the Ethereum network. Launched in 2

019, WBTC allows Bitcoin holders to utilize their assets within the Ethereum ecosystem, thereby enabling them to take advantage of decentralized finance (DeFi) applications. Each WBTC is backed 1:1 by BTC held in custody by a network of trusted custodians, ensuring that its value reflects that of Bitcoin. This bridging of assets allows for increased liquidity and expands the use cases of Bitcoin beyond simple transactions.

Key Differences Between BTC and WBTC

One of the most significant differences between BTC and WBTC lies in their underlying blockchain technology. BTC exists on its own blockchain, while WBTC leverages Ethereum’s capabilities. This distinction brings about various functionalities:

- Purpose: BTC is primarily used for value storage and transfer, whereas WBTC enables Bitcoin to participate in DeFi, allowing users to lend, borrow, and trade in the Ethereum ecosystem.

- Technology: BTC operates on its native protocol, offering a secure and decentralized environment. In contrast, WBTC is an ERC-20 token, benefiting from Ethereum’s smart contract capabilities.

- Liquidity: WBTC contributes to higher liquidity in DeFi markets. Users can exchange WBTC for other ERC-20 tokens, enhancing trading opportunities.

- Custodianship: WBTC relies on a network of custodians to manage the Bitcoin backing its ERC-20 token, creating a trust basis that is different from BTC’s purely decentralized model.

Use Cases of BTC and WBTC

The use cases for these two assets vary significantly:

- BTC: Traditionally accepted for online payments, investment, and as a hedge against market volatility.

- WBTC: Mainly utilized in DeFi applications, allowing Bitcoin holders to earn interest, collateralize loans, and trade against various cryptocurrencies within the Ethereum ecosystem.

In conclusion, while both BTC and WBTC represent Bitcoin in their respective ecosystems, they serve different purposes and operate using different technologies. BTC is a store of value and means of exchange, while WBTC provides access to innovative financial applications within the Ethereum network. Understanding their differences is crucial for making informed investment and trading decisions in the ever-evolving cryptocurrency landscape.