BTC Long ETF: Investment Opportunities and Market Insights

The rise of cryptocurrencies has led to the development of innovative financial products, including Bitcoin (BTC) long exchange-traded funds (ETFs). This article explores the features, benefits, and market dynamics surrounding BTC long ETFs, helping investors understand their potential as a viable investment option.

The rise of cryptocurrencies has led to the development of innovative financial products, including Bitcoin (BTC) long exchange-traded funds (ETFs). This article explores the features, benefits, and market dynamics surrounding BTC long ETFs, helping investors understand their potential as a viable investment option.

Understanding BTC Long ETFs

A Bitcoin long ETF is a type of exchange-traded fund that allows investors to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency. This financial instrument is designed to track the price of Bitcoin, enabling investors to benefit from bullish market sentiments. Unlike short ETFs, which profit when asset prices fall, BTC long ETFs are focused on capitalizing on upward trends in Bitcoin pricing.

How BTC Long ETFs Work

BTC long ETFs work by holding Bitcoin futures contracts or actual Bitcoin as underlying assets. When investors purchase shares of the ETF, they effectively invest in the performance of Bitcoin without the complexities of wallets, private keys, and security concerns associated with direct cryptocurrency ownership. This structure simplifies the investment process, making it accessible to a broader range of investors who may be hesitant to engage directly in the cryptocurrency market.

Advantages of Investing in BTC Long ETFs

1. Convenience: BTC long ETFs are traded on traditional stock exchanges, allowing investors to buy and sell shares during market hours, just like stocks. This ease of trading can enhance liquidity and provide real-time access to Bitcoin’s performance.

2. Regulation: BTC long ETFs operate under established regulatory frameworks, offering a layer of protection for investors. This regulatory oversight can bolster investor confidence, particularly for individuals new to Bitcoin trading.

3. Diversification: Investing in a BTC long ETF allows for greater diversification in a portfolio. Investors can gain exposure to Bitcoin while also holding other asset classes, mitigating risk associated with volatility in the cryptocurrency market.

Market Trends Influencing BTC Long ETFs

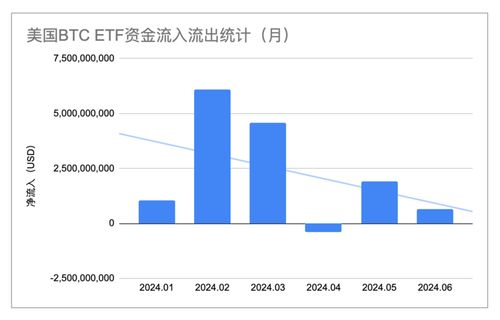

The popularity of BTC long ETFs is heavily influenced by market trends, regulatory developments, and investor sentiment. The increasing institutional adoption of Bitcoin, alongside growing public interest, continues to propel demand for BTC long ETFs. Additionally, favorable regulatory news can act as a catalyst for price surges, thereby positively affecting the value of these ETFs.

In conclusion, BTC long ETFs present a compelling option for investors looking to benefit from Bitcoin’s upward potential. By offering convenience, regulatory assurance, and diversification opportunities, these financial products cater to traditional investors as well as crypto enthusiasts. Understanding the market dynamics and trends influencing BTC long ETFs is crucial for making informed investment decisions.