Top Short-Term Cryptocurrency Investments, Quick Profits and Opportunities

In the rapidly evolving world of cryptocurrency, short-term investments can yield significant returns for savvy investors. This article delves into the best strategies and options for short-term crypto investments, identifying potential coins that are ripe for quick profits. With a focus on trends and market analysis, you’ll find essential information to navigate these fast-paced waters successfully.

In the rapidly evolving world of cryptocurrency, short-term investments can yield significant returns for savvy investors. This article delves into the best strategies and options for short-term crypto investments, identifying potential coins that are ripe for quick profits. With a focus on trends and market analysis, you’ll find essential information to navigate these fast-paced waters successfully.

Understanding Short-Term Cryptocurrency Investments

Short-term investments in cryptocurrency refer to buying and selling digital assets over a brief period, typically ranging from days to months. Traders focus on maximizing returns by capitalizing on frequent price fluctuations. The appeal of short-term strategies lies in the potential for rapid gains, making this investment approach attractive, especially in a highly volatile market.

To effectively engage in short-term crypto investments, one must have a solid grasp of market trends, varying price patterns, and the ability to react promptly to market changes. A proactive approach can help investors identify promising cryptocurrencies that present opportunities for immediate profit.

Key Strategies for Identifying Promising Cryptocurrencies

1. Market Analysis: Keeping an eye on the latest market trends, news, and technological developments is crucial. Major events, such as regulatory changes or significant partnerships, can impact coin prices dramatically. Active participation in crypto forums and following market analysts can provide valuable insights.

2. Technical Analysis: Utilize technical analysis tools to assess price movements. Charts and indicators, like moving averages and RSI (Relative Strength Index

), can help predict short-term price changes. Understanding historical price patterns can provide a solid basis for making informed investment decisions.

3. Diversification: Invest in multiple cryptocurrencies instead of putting all funds into a single asset. This approach mitigates risks and increases the chances of at least one coin performing well. Diversification is a key aspect of a robust short-term investment strategy.

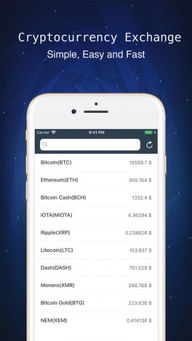

Popular Cryptocurrencies for Short-Term Investments

When considering short-term crypto investments, it is essential to identify coins that have shown potential for quick price increases. Here are a few popular choices:

– Ethereum (ETH): As one of the largest cryptocurrencies by market cap, ETH consistently shows volatility, making it an excellent candidate for short-term trading.

– Binance Coin (BNB): Known for its strong performance and utility within the Binance Exchange, BNB can experience significant price movements that traders can exploit.

– Ripple (XRP): Often subject to intense market speculation, XRP offers substantial opportunities for quick investments, though it also carries risks dependent on legal proceedings affecting the company.

– Cardano (ADA): With ongoing development and community interest, ADA has proven to be a resilient coin that traders can leverage for short-term gains.

By implementing research, maintaining a diversified portfolio, and continuously analyzing market trends, investors can position themselves to take advantage of short-term cryptocurrency investments. The marketplace is dynamic, and having strategies in place can help enthusiasts capitalize on the exciting opportunities that arise in the crypto space.