Large Currency Stocks, An Overview of Their Potential and Performance

In recent years, the market for large currency stocks has gained immense popularity among investors seeking to capitalize on the potential growth of cryptocurrencies and blockchain technology. This article aims to provide insights into large currency stocks, exploring their performance, potential risks, and possible investment strategies.

In recent years, the market for large currency stocks has gained immense popularity among investors seeking to capitalize on the potential growth of cryptocurrencies and blockchain technology. This article aims to provide insights into large currency stocks, exploring their performance, potential risks, and possible investment strategies.

Understanding Large Currency Stocks

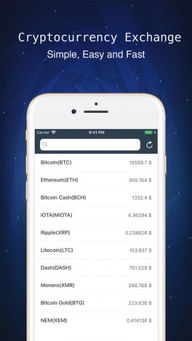

Large currency stocks typically refer to investments in significant cryptocurrencies like Bitcoin and Ethereum, or stocks of companies heavily involved in the cryptocurrency space. These stocks have shown considerable price volatility and unique market dynamics compared to traditional stocks. Investors are often attracted to the high potential returns associated with these assets.

One of the main features of large currency stocks is their correlation with the underlying blockchain technology. Companies that are engaged in mining, trading, or developing blockchain solutions offer promising investment opportunities. Understanding how these companies operate and their market position is key for potential investors.

Recent Performance Trends of Large Currency Stocks

The performance of large currency stocks has seen significant fluctuations, influenced by market sentiment, regulatory developments, and technological advancements. In 2

021, for instance, Bitcoin experienced a dramatic rise, reaching all-time highs, leading to increased interest from institutional investors. However, subsequent corrections showcased the market’s inherent volatility, prompting many to carefully reassess their investment strategies.

Investors must also pay attention to macroeconomic factors affecting large currency stocks. Economic changes, inflation rates, and global trends can greatly influence cryptocurrency prices and consequently the stocks tied to them. Staying updated on news and analysis becomes crucial for making informed investment decisions.

Investing Strategies for Large Currency Stocks

When it comes to investing in large currency stocks, creating a robust strategy is vital. Here are some strategies that can help maximize returns while managing risks:

- Do Your Research: Thoroughly analyzing the companies behind the large currency stocks is essential. Review their financials, understand their market position, and assess their long-term viability.

- Diversification: Just as with traditional investments, diversifying your portfolio can reduce risk. Consider including a mix of cryptocurrency stocks and traditional assets to balance potential gains and losses.

- Risk Management: Establishing clear entry and exit points for trading large currency stocks can help mitigate losses. It’s vital to set stop-loss orders and stick to your predetermined risk levels.

In summary, large currency stocks present both opportunities and challenges for investors. By understanding the dynamics of these stocks, analyzing recent performance trends, and employing effective investment strategies, individuals can position themselves to take advantage of the potential growth in the cryptocurrency space while managing associated risks. As with any investment, thorough research and cautious planning play critical roles in achieving success.