btc dominance,BTC Dominance: A Comprehensive Overview

BTC Dominance: A Comprehensive Overview

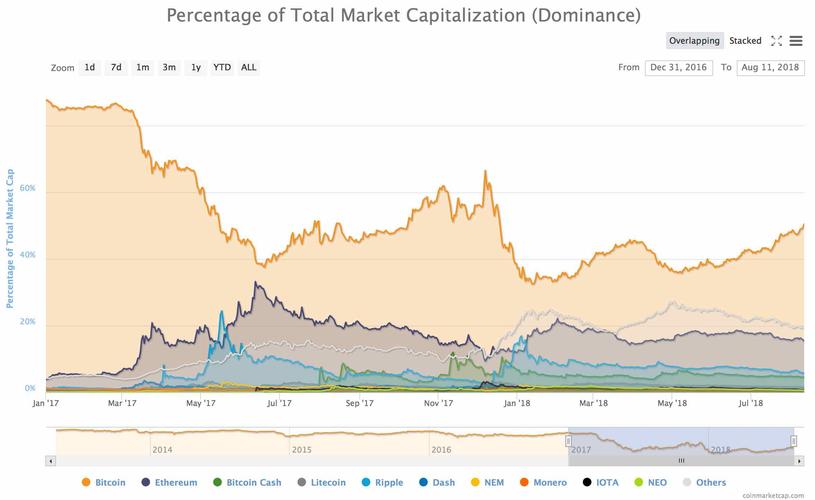

Understanding the concept of Bitcoin dominance is crucial for anyone interested in the cryptocurrency market. BTC dominance refers to the percentage of the total market capitalization that is held by Bitcoin. This metric is often used as a gauge to measure the influence of Bitcoin in the crypto space. In this article, we will delve into the various aspects of BTC dominance, its implications, and how it affects the broader cryptocurrency market.

What is BTC Dominance?

BTC dominance is calculated by dividing the market capitalization of Bitcoin by the total market capitalization of all cryptocurrencies. This percentage indicates the proportion of the entire crypto market that is controlled by Bitcoin. For instance, if Bitcoin’s market capitalization is $1 trillion and the total market capitalization of all cryptocurrencies is $2 trillion, BTC dominance would be 50%.

Historical Perspective

Over the years, BTC dominance has fluctuated significantly. Initially, Bitcoin was the sole cryptocurrency in existence, and its dominance was naturally 100%. However, as the market expanded, other cryptocurrencies gained traction, leading to a decrease in Bitcoin’s dominance. In 2017, Bitcoin’s dominance reached an all-time high of around 70%. Since then, it has experienced several ups and downs, with its current dominance hovering around 50%.

Factors Influencing BTC Dominance

Several factors contribute to the fluctuations in BTC dominance:

-

Market Sentiment: Positive news about Bitcoin often leads to an increase in its dominance, while negative news can cause it to decline.

-

Adoption Rate: The adoption of Bitcoin by both retail and institutional investors can significantly impact its dominance.

-

Competition: The rise of alternative cryptocurrencies, such as Ethereum, can challenge Bitcoin’s dominance.

-

Market Capitalization: The market capitalization of other cryptocurrencies can also influence BTC dominance.

Implications of BTC Dominance

BTC dominance has several implications for the cryptocurrency market:

-

Market Stability: A higher BTC dominance can indicate a more stable market, as Bitcoin is often considered the “safe haven” of the crypto space.

-

Market Sentiment: BTC dominance can influence the sentiment of other cryptocurrencies, leading to a ripple effect in the market.

-

Investment Opportunities: Understanding BTC dominance can help investors make informed decisions about their cryptocurrency investments.

Table: BTC Dominance Over the Years

| Year | BTC Dominance |

|---|---|

| 2011 | 100% |

| 2013 | 90% |

| 2015 | 80% |

| 2017 | 70% |

| 2018 | 60% |

| 2019 | 65% |

| 2020 | 60% |

| 2021 | 50% |

Conclusion

BTC dominance is a critical metric that reflects the influence of Bitcoin in the cryptocurrency market. By understanding the factors that influence BTC dominance and its implications, investors can make more informed decisions about their cryptocurrency investments. As the market continues to evolve, keeping an eye on BTC dominance will remain an essential aspect of navigating the crypto space.