Discreet Bitcoin Initiation: Understanding the Basics, Strategies, and Risks

In the world of cryptocurrencies, Bitcoin has emerged as a significant player, attracting attention from investors worldwide. This article aims to provide a comprehensive guide on how to start your Bitcoin journey discreetly, covering essential aspects, strategies, and the risks involved.

In the world of cryptocurrencies, Bitcoin has emerged as a significant player, attracting attention from investors worldwide. This article aims to provide a comprehensive guide on how to start your Bitcoin journey discreetly, covering essential aspects, strategies, and the risks involved.

Understanding Bitcoin Basics

Bitcoin, the first decentralized digital currency, operates without a central authority. Introduced in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto, it allows peer-to-peer transactions over a blockchain—a distributed ledger technology. As a low-key individual, it’s crucial to grasp the fundamental concepts of Bitcoin before diving into the investment.

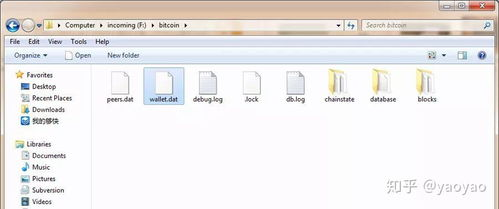

To initiate your Bitcoin journey, familiarize yourself with terms like wallets, exchanges, and private keys. A Bitcoin wallet is where you’ll store your currency, while exchanges are platforms that facilitate buying and selling Bitcoin. Understanding these elements is vital for anyone looking to invest discreetly.

Choosing the Right Bitcoin Wallet

Selecting a suitable wallet is an essential step in your Bitcoin journey. There are several types: hardware wallets, software wallets, and paper wallets. Hardware wallets, like Ledger or Trezor, provide offline storage for added security, making them ideal for low-key investors. Software wallets, such as Exodus, are more convenient but come with potential security risks.

For someone who prefers privacy, a paper wallet might be appealing. It allows users to store their Bitcoin offline, reducing exposure to online threats. However, one must ensure to keep their private keys secure, as losing them means losing access to their funds.

Discreet Trading Strategies

When you’re ready to purchase Bitcoin, consider using anonymous exchanges or peer-to-peer (P2P) platforms. P2P exchanges, such as LocalBitcoins and Paxful, enable transactions directly between users, often without the need for extensive identity verification. This can significantly enhance your privacy when buying Bitcoin.

Moreover, you may want to avoid drawing attention to your trades by using decentralized exchanges (DEXs) that don’t require personal information. However, always ensure to perform due diligence on the platforms you choose, as lower regulation might attract scams.

Acknowledging the Risks

As you embark on your discreet Bitcoin journey, it’s crucial to acknowledge the inherent risks involved. The cryptocurrency market is highly volatile, with prices fluctuating dramatically over short periods. Only invest what you can afford to lose and consider diversifying your portfolio to mitigate potential losses.

Furthermore, security is paramount. Regularly update your wallet software, use strong passwords, and enable two-factor authentication (2FA) where possible. Protecting your investment from theft or loss should always be a priority for any investor, especially those who prefer to keep a low profile.

In summary, starting your Bitcoin journey discreetly involves understanding the basics, choosing the right wallet and trading strategies, and acknowledging the risks involved. By following these guidelines, you can navigate the world of Bitcoin while maintaining your low-key lifestyle.