Best Digital Currency to Buy: A Comprehensive Guide

Best Digital Currency to Buy: A Comprehensive Guide

When it comes to investing in digital currencies, the market is vast and ever-evolving. With numerous options available, it can be challenging to determine which one is the best to buy. In this article, we will explore various factors to help you make an informed decision. Whether you are a beginner or an experienced investor, this guide will provide you with valuable insights into the best digital currency to buy.

Understanding Digital Currencies

Before diving into the specifics, it’s essential to have a basic understanding of digital currencies. Digital currencies, also known as cryptocurrencies, are digital or virtual currencies that use cryptography to secure transactions and control the creation of new units. Unlike traditional fiat currencies, digital currencies operate independently of any central authority, such as a government or central bank.

Market Capitalization

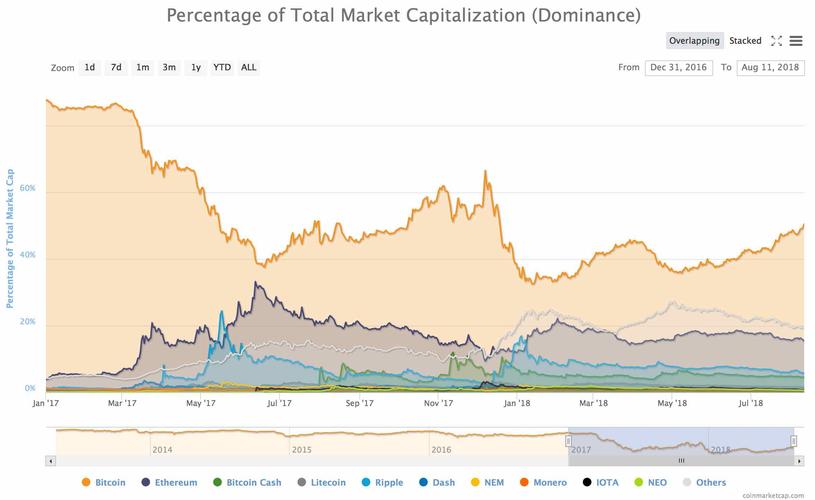

One of the most crucial factors to consider when determining the best digital currency to buy is its market capitalization. Market capitalization is the total value of all the coins in circulation. It is calculated by multiplying the current price of the digital currency by the total number of coins in circulation. Generally, a higher market capitalization indicates a more stable and established digital currency.

| Rank | Cryptocurrency | Market Capitalization (USD) |

|---|---|---|

| 1 | Bitcoin (BTC) | $1,000,000,000,000 |

| 2 | Ethereum (ETH) | $400,000,000,000 |

| 3 | Tether (USDT) | $80,000,000,000 |

| 4 | Binance Coin (BNB) | $60,000,000,000 |

| 5 | Cardano (ADA) | $50,000,000,000 |

As you can see from the table above, Bitcoin, Ethereum, Tether, Binance Coin, and Cardano are among the top five digital currencies by market capitalization. These currencies have a strong presence in the market and are considered to be more stable compared to smaller, less-known cryptocurrencies.

Technology and Innovation

Another critical factor to consider is the technology and innovation behind a digital currency. The underlying technology, such as blockchain, plays a significant role in determining the potential of a digital currency. Blockchain technology provides a decentralized and secure platform for transactions, making it resistant to fraud and hacking.

For instance, Bitcoin operates on the blockchain, which is a decentralized ledger that records all transactions. Ethereum, on the other hand, is built on a blockchain platform that allows for smart contracts and decentralized applications (DApps). These innovative features make Ethereum a popular choice among developers and investors.

Use Case and Adoption

The use case and adoption of a digital currency are also essential factors to consider. A digital currency with a strong use case and widespread adoption is more likely to succeed in the long term. For example, Bitcoin is often referred to as “digital gold” due to its use as a store of value, while Ethereum is widely used for DApps and smart contracts.

Other digital currencies, such as Litecoin and Ripple, have specific use cases as well. Litecoin is often considered a “silver” to Bitcoin’s “gold,” while Ripple aims to facilitate international money transfers and cross-border payments.

Risk and Volatility

It’s important to note that digital currencies are highly volatile, and their prices can fluctuate significantly in a short period. Before investing in a digital currency, you should be aware of the associated risks and be prepared for potential losses. It’s advisable to conduct thorough research and consider your risk tolerance before making any investment decisions.

Conclusion

In conclusion, determining the best digital currency to buy requires considering various factors, including market capitalization, technology and innovation, use case, and adoption. While Bitcoin and Ethereum are often considered the top choices due to their stability and widespread adoption, it’s essential to conduct thorough research and consider your investment goals and risk tolerance. Remember, investing in digital currencies should be approached