0.01958000 btc,Understanding Bitcoin

Are you curious about the digital currency that has been making waves in the financial world? Have you ever wondered what it’s like to own a tiny fraction of Bitcoin, like 0.01958000 BTC? Well, you’ve come to the right place. In this article, we’ll delve into the intricacies of Bitcoin, exploring its history, technology, and the potential it holds for your investment portfolio.

Understanding Bitcoin

Bitcoin, often referred to as the “digital gold,” is a decentralized cryptocurrency that operates on a peer-to-peer network. Unlike traditional fiat currencies, Bitcoin is not controlled by any central authority, such as a government or a central bank. Instead, it relies on a technology called blockchain to record and verify transactions.

Blockchain is a distributed ledger that keeps a record of all Bitcoin transactions in a secure and transparent manner. Each transaction is grouped into a “block,” which is then added to a chain of previous blocks. This chain of blocks, or blockchain, is maintained by a network of computers, known as nodes, across the globe.

The Technology Behind Bitcoin

Bitcoin’s underlying technology is based on several key components:

-

Decentralization: Bitcoin’s network is decentralized, meaning that no single entity has control over it. This makes it resistant to censorship and manipulation.

-

Blockchain: The blockchain is a public ledger that records all Bitcoin transactions. It is secure, transparent, and immutable, ensuring that no one can alter the transaction history.

-

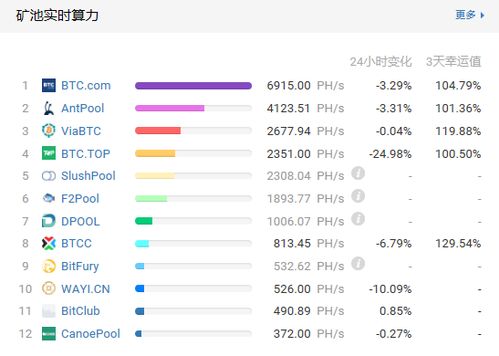

Proof of Work (PoW): Bitcoin’s network uses PoW to validate transactions and create new blocks. Miners compete to solve complex mathematical puzzles, and the first to solve the puzzle gets to add a new block to the blockchain.

-

Public and Private Keys: Each Bitcoin user has a pair of keys鈥攁 public key and a private key. The public key is used to receive Bitcoin, while the private key is used to sign transactions and prove ownership.

The Value of Bitcoin

Bitcoin’s value has been on a rollercoaster ride since its inception in 2009. As of now, the price of Bitcoin is hovering around $10,000. However, it’s important to note that the value of Bitcoin is highly volatile and can fluctuate significantly in a short period of time.

Several factors contribute to Bitcoin’s value, including:

-

Supply and Demand: Bitcoin has a finite supply of 21 million coins, which makes it a scarce asset. As the demand for Bitcoin increases, its value tends to rise.

-

Market Sentiment: The perception of Bitcoin as a store of value and a hedge against inflation can drive its price up.

-

Regulatory Environment: The regulatory stance of governments towards Bitcoin can impact its value. For example, if a government bans Bitcoin, its value may plummet.

Investing in Bitcoin

Investing in Bitcoin can be an exciting opportunity, but it also comes with its own set of risks. Here are some tips to consider when investing in Bitcoin:

-

Do Your Research: Understand the technology behind Bitcoin and the factors that influence its value.

-

Understand the Risks: Be aware that Bitcoin is a highly volatile asset, and its value can plummet as quickly as it rises.

-

Start Small: Don’t invest more than you can afford to lose.

-

Use a Secure Wallet: Store your Bitcoin in a secure wallet to protect it from theft and loss.

Table: Bitcoin Price History

| Year | Price per BTC |

|---|---|

| 2010 | $0.00008 |

| 2011 | $1.00 |

| 2012 | $12.00 |