bitcoing price,Understanding Bitcoin Price: A Comprehensive Guide for You

Understanding Bitcoin Price: A Comprehensive Guide for You

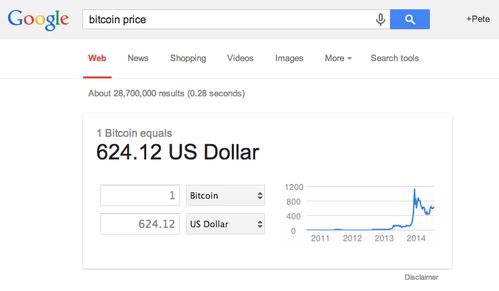

Bitcoin, the pioneer of the cryptocurrency world, has been a topic of great interest for investors, enthusiasts, and the general public alike. Its price has seen dramatic fluctuations over the years, making it a highly dynamic and unpredictable asset. In this article, we will delve into the various factors that influence the Bitcoin price, providing you with a comprehensive understanding of this fascinating digital currency.

Market Supply and Demand

The fundamental principle of any market, including the Bitcoin market, is supply and demand. The price of Bitcoin is determined by the number of people willing to buy it and the number of people willing to sell it. When demand for Bitcoin increases, its price tends to rise, and vice versa. Let’s take a look at some key factors that affect the supply and demand of Bitcoin:

| Factor | Description |

|---|---|

| Adoption Rate | The rate at which new users join the Bitcoin network. |

| Market Sentiment | The overall mood of the market, influenced by news, rumors, and speculation. |

| Regulatory Environment | The laws and regulations that govern the use and trading of Bitcoin. |

| Technological Developments | Innovations and improvements in the Bitcoin network and ecosystem. |

Adoption rate plays a crucial role in determining the demand for Bitcoin. As more people and businesses start to accept Bitcoin as a payment method, the demand for the cryptocurrency increases, potentially driving up its price. Market sentiment, on the other hand, can be highly volatile and unpredictable. News, rumors, and speculation can quickly shift the mood of the market, leading to rapid price movements.

Market Cap and Liquidity

Market capitalization (market cap) is another important factor that influences the Bitcoin price. It represents the total value of all Bitcoin in circulation. A higher market cap indicates a larger and more established market, which can make Bitcoin more attractive to investors. Liquidity, or the ease of buying and selling Bitcoin, also plays a significant role in determining its price. High liquidity means that Bitcoin can be bought and sold quickly without causing significant price changes.

Bitcoin Halving Events

Bitcoin halving events are periodic events that occur approximately every four years. During these events, the reward for mining a new block is halved, effectively reducing the rate at which new Bitcoin is created. This reduction in supply can lead to an increase in demand, potentially driving up the price of Bitcoin. The next Bitcoin halving event is expected to take place in 2024, and many investors are closely watching to see how it will impact the market.

Global Economic Factors

The global economy and its various factors can also have a significant impact on the Bitcoin price. For instance, during times of economic uncertainty, such as a financial crisis or a recession, investors may turn to Bitcoin as a safe haven asset. This increased demand can drive up the price of Bitcoin. Additionally, changes in interest rates, inflation, and currency fluctuations can also influence the Bitcoin price.

Technological and Security Concerns

The security and technological aspects of the Bitcoin network are crucial for its long-term success. Any issues or concerns regarding the network’s security or scalability can lead to a decrease in confidence among users and investors, potentially causing the price to drop. Conversely, positive technological developments, such as improvements in the network’s performance or the launch of new Bitcoin-based products and services, can boost the price.

Conclusion

Understanding the factors that influence the Bitcoin price is essential for anyone interested in investing or trading in this digital currency. By considering market supply and demand, market cap and liquidity, Bitcoin halving events, global economic factors, and technological and security concerns, you can gain a comprehensive understanding of the Bitcoin market and make more informed decisions. Remember that the cryptocurrency market is highly volatile, and it’s important to do your research and stay informed before making any investment decisions.