bitcoin volume,Understanding Bitcoin Volume: A Comprehensive Guide

Understanding Bitcoin Volume: A Comprehensive Guide

Bitcoin, the world’s first decentralized cryptocurrency, has captured the attention of investors and enthusiasts alike. One of the key metrics that often comes up in discussions about Bitcoin is its trading volume. In this article, we delve into what Bitcoin volume means, how it’s calculated, and its significance in the cryptocurrency market.

What is Bitcoin Volume?

Bitcoin volume refers to the total number of Bitcoin transactions that have occurred over a specific period. It is a measure of the activity and liquidity in the Bitcoin market. The volume is typically expressed in Bitcoin (BTC) or in fiat currency, depending on the source of the data.

How is Bitcoin Volume Calculated?

Calculating Bitcoin volume is relatively straightforward. It involves summing up the total value of all Bitcoin transactions that have taken place within a given time frame. This value is usually obtained from cryptocurrency exchanges, which report their trading data to various platforms and services.

Here’s a simple formula to calculate Bitcoin volume:

| Number of Transactions | Transaction Value (BTC) | Total Volume (BTC) |

|---|---|---|

| 100 | 0.1 | 10 |

| 200 | 0.2 | 40 |

| 300 | 0.3 | 90 |

In this example, the total volume of Bitcoin transactions is 10 BTC, calculated by adding the transaction values from each row.

Significance of Bitcoin Volume

Bitcoin volume is a crucial indicator for several reasons:

-

Market Liquidity: High trading volume suggests that there is a significant level of liquidity in the market, making it easier for investors to buy and sell Bitcoin without significantly impacting its price.

-

Market Activity: A high volume of transactions indicates that the market is active, which can be a sign of strong interest and confidence in Bitcoin.

-

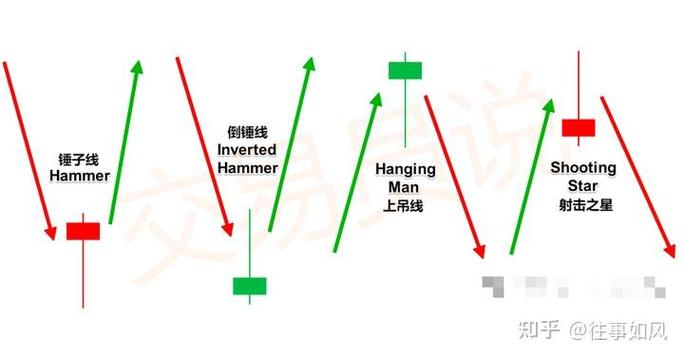

Price Movement: Bitcoin volume can provide insights into potential price movements. For instance, a sudden surge in volume may indicate that a significant number of investors are entering or exiting the market, which could lead to price volatility.

Comparing Bitcoin Volume with Other Cryptocurrencies

When analyzing Bitcoin volume, it’s also important to consider how it compares with other cryptocurrencies. Bitcoin remains the largest and most widely traded cryptocurrency, so its volume is often significantly higher than that of other altcoins. However, the volume of other cryptocurrencies can still provide valuable insights into the broader cryptocurrency market.

Bitcoin Volume and Market Trends

Bitcoin volume can be influenced by various factors, including market trends, regulatory news, and technological advancements. For example:

-

Market Trends: During bull markets, Bitcoin volume tends to increase as more investors enter the market. Conversely, during bear markets, volume may decrease as investors exit.

-

Regulatory News: Announcements of new regulations or changes in existing regulations can significantly impact Bitcoin volume, as they may affect investor confidence and market sentiment.

-

Technological Advancements: Innovations in blockchain technology or improvements in the Bitcoin network can also influence volume, as they may attract new users and investors.

Conclusion

Bitcoin volume is a vital metric for understanding the activity and liquidity in the cryptocurrency market. By analyzing Bitcoin volume, investors and enthusiasts can gain insights into market trends, potential price movements, and the overall health of the market. As the cryptocurrency market continues to evolve, keeping an eye on Bitcoin volume will remain an essential part of understanding the market dynamics.