bitcoin for sale,Understanding Bitcoin for Sale: A Comprehensive Guide

Understanding Bitcoin for Sale: A Comprehensive Guide

Are you considering selling your Bitcoin? Whether you’re looking to diversify your investment portfolio, meet financial obligations, or simply explore new opportunities, understanding the process and implications of selling Bitcoin is crucial. This guide will delve into the various aspects of selling Bitcoin, from market dynamics to legal considerations.

Market Dynamics

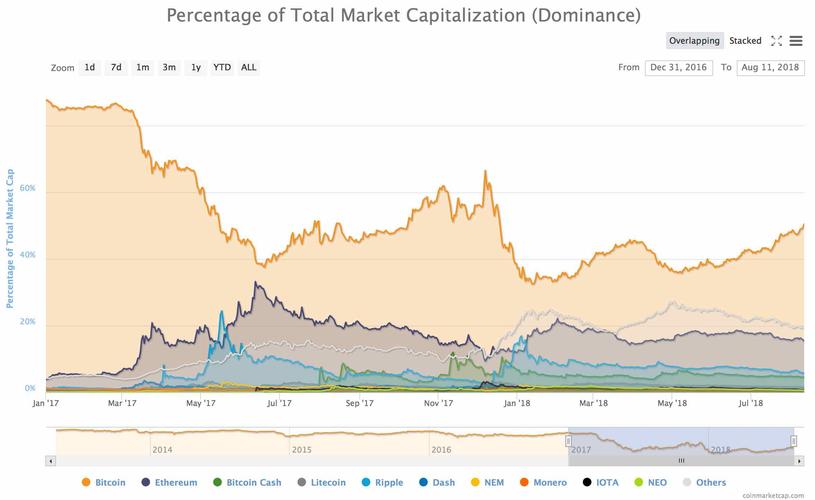

Before diving into the sale of Bitcoin, it’s essential to understand the current market dynamics. The value of Bitcoin is subject to significant volatility, influenced by factors such as global economic conditions, regulatory news, and technological advancements. To get a sense of the market, you can refer to reputable cryptocurrency exchanges like Coinbase, Binance, and Kraken, which provide real-time price charts and historical data.

| Exchange | Real-Time Price | 24-hour High/Low |

|---|---|---|

| Coinbase | $30,000 | $29,500 – $30,500 |

| Binance | $30,200 | $29,800 – $30,300 |

| Kraken | $30,100 | $29,700 – $30,200 |

Choosing a Platform

When selling Bitcoin, you have several options for platforms. These include cryptocurrency exchanges, peer-to-peer marketplaces, and online wallets. Each platform has its own set of features, fees, and security measures. It’s crucial to research and compare these options to find the one that best suits your needs.

- Cryptocurrency Exchanges: These platforms allow you to sell Bitcoin directly to other users or to the exchange itself. They often offer competitive fees and a wide range of trading options. Examples include Coinbase, Binance, and Kraken.

- Peer-to-Peer Marketplaces: These platforms connect buyers and sellers directly, allowing for more privacy and potentially higher profit margins. Examples include LocalBitcoins and Paxful.

- Online Wallets: Some online wallets offer the option to sell Bitcoin directly from your wallet. This can be a convenient option if you already have Bitcoin stored in a wallet. Examples include Blockchain.com and Electrum.

Security Considerations

Security is a critical factor when selling Bitcoin. Ensure that you use a reputable platform with strong security measures, such as two-factor authentication and cold storage for your Bitcoin. Additionally, be cautious of phishing scams and always verify the identity of the buyer or seller before completing a transaction.

Legal Considerations

The legal status of Bitcoin varies by country, and it’s crucial to understand the regulations in your jurisdiction. In some countries, Bitcoin is considered a legal currency, while in others, it’s treated as a commodity or a speculative investment. Here are some key considerations:

- Tax Implications: In many countries, selling Bitcoin is subject to capital gains tax. Be sure to consult with a tax professional to understand your specific tax obligations.

- Regulatory Compliance: Some countries have specific regulations regarding the purchase, sale, and storage of Bitcoin. Ensure that you comply with these regulations to avoid legal consequences.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Many platforms require you to complete an AML and KYC process before you can sell Bitcoin. This process helps prevent financial crimes and ensures the legitimacy of your transaction.

Conclusion

Selling Bitcoin can be a complex process, but by understanding the market dynamics, choosing the right platform, and considering legal and security factors, you can navigate the process with confidence. Remember to do thorough research and consult with professionals as needed to ensure a smooth and successful transaction.